Customer Intelligence

Act on Insights, Not Instincts

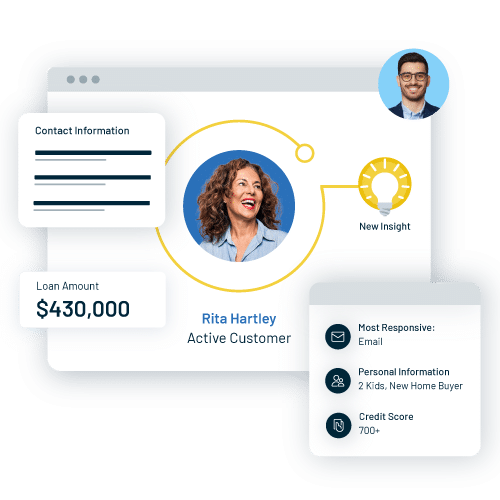

Enrich your customer profiles with ongoing, proactive data insights that help you truly understand their financial needs and goals, identify critical moments to engage high-quality opportunities, and fuel long-term growth.

Enriched customer profiles

Turn data into deeper customer relationships

Data enrichment is the key to creating truly comprehensive customer profiles. Legacy CRM platforms are limited to static customer records that tell you nothing about the circumstances driving their financial decisions. Total Expert Customer Intelligence creates dynamic, actionable customer records by continuously aggregating relevant behavioral, demographic, and financial data. Now, you can deliver highly personalized content and product offers through automated Journeys the moment a customer signals a financial need. The result: more revenue, more wallet share, and more customers for life.

System of intelligence + system of action

Your data knows what customers want. Do you?

Surface customer intent to understand their goals, identify opportunities to engage, and deliver the next best product or service at every stage of the financial journey.

Create robust customer profiles that support personalized, authentic communications by combining your existing data with aggregated, publicly available third-party data.

Engage customers at the moments that matter with real-time data monitoring and automated alerts for events that drive financial decisions.

Define your target audiences, surface high-quality opportunities, and deliver truly personalized Journeys for every consumer.

Deliver seamless customer experiences across every channel with a mix of automated digital engagements and human outreach.

Customer success

1.6B

Journey events

2.3M

Tasks created

523M

Emails created

5.3M

Insights generated

$22.2B

Application volume generated

$13.3B

Funded volume generated

ROI Calculator

See how many opportunities could be hiding in your database

Customer Intelligence monitors contacts in your database to identify specific opportunities to provide financial education, products, or services. Then, Total Expert notifies your customer-facing teams when there’s an opportunity to reach out with personalized communications. Our ROI calculator will estimate the potential annual revenue that Customer Intelligence could help you drive.

Total Expert, Inc. – ROI Calculator Disclaimer

This calculator is designed to be informational only and does not constitute investment advice. This calculator is provided as a rough approximation of potential future return on investment (“ROI”) based on the internal data and experience of Total Expert, Inc. The results presented by this calculator are hypothetical and may not reflect any actual ROI. Total Expert, Inc. and its affiliates are not responsible for the consequences of any decisions or actions taken in reliance upon or as a result of the information provided by this calculator.

Please note: If the percentage entered in “Mortgage Penetration to Retail Base” is higher than the percentage resulting from dividing the “Mortgage Base” by the “Retail Base”, the calculator will return an error message. Please update the “Mortgage Penetration to Retail Base” to correct this error.

See Customer Intelligence in Action

Gain a better understanding of your customers’ needs, uncover more opportunities, and deliver truly personalized messaging at every stage of their financial journey with tools that monitor behavior across your entire tech stack.

Mortgage database monitoring for lenders and loan officers.

Your database is filled with mortgage opportunities. Learn how Customer Intelligence can help you uncover them and keep borrowers engaged until they’re ready to take the next step.

Retail base insights for banks and credit unions.

Identify account holders who are preparing to make a mortgage-related decision and engage them with communications and resources to guide them along their journey and become their trusted financial partner.

I can tie $2M in closed volume directly to Total Expert Customer Intelligence. 10% of my overall volume in 2024 has come from Customer Intelligence.

Matt Shaver

Senior Loan Officer at SynergyOne Lending

System of Intelligence

Identify and surface every opportunity

Leverage real-time data to create holistic customer profiles, monitor your database for key financial behaviors, and automatically surface high-quality opportunities the moment they signal intent to act.

Profile Enrichment

Gain a better understanding of your customers and their financial situation by pulling in data from across your tech stack and using it to create dynamic profiles that help your sales and marketing teams provide personalized communications and seamless experiences across every channel.

Insights + Alerts

Know the moment a customer has a financial need or experiences a major life event by constantly monitoring your database for specific activities or pre-determined financial thresholds so you can deliver the next best product, service, or resource.

System of Action

Engage customers at moments that matter

Turn data into deeper customer relationships by consistently delivering timely, relevant communications by segmenting your database based on target audiences and using real-time data to fuel hyper-personalized Journeys that adapt to each customer’s behaviors and communication preferences.

Contact Segmentation

Group the contacts in your database based on specific criteria to quickly identify opportunities for engagement based on your business’ goals and your customers’ needs.

Personalized Journeys

Create a seamless customer experience across every channel with a mix of automated digital communications and human touchpoints; ensuring that you always deliver the next best product or service and make an impact with every interaction.

“We’ve been able to leverage the platform to create business for our loan officers that may have otherwise been missed. This solution allows us to gain insights on borrowers in a way that we would never be able to achieve organically. Not only does it help us determine that our customers may have a mortgage need, but it seamlessly sets them on a journey, putting our loan officers front of mind.”

Jelaire Grillo, Brand Ambassador at Prosperity Home Mortgage, LLC.

MORE THAN A PLATFORM

We’re here to support your people and your goals

Tools and technology are only as effective as the people who use them. That’s why we provide dedicated support, expert guides, and education resources for every customer—all from a team that’s deeply passionate and knowledgeable about banking and lending.

Professional services

Make the most of your investment by tapping into a team dedicated to your success out of the gates.

Education & guides

Elevate your sales and marketing approach alongside a team built to ensure adoption and success.

See it in action

We know that seeing is believing. Let us show you the power of Total Expert.

Knowledge & insights

Stay up to date with the latest financial news, industry trends, and Total Expert tips.