Segmentation + Journeys

Divide and Contact. Personalize Your Customer Experience at Every Financial Milestone.

Create highly targeted contact lists in your database to deliver the most impactful message every time you engage with them. Our dynamic Journeys combine digital communications and human outreach to help you guide each customer at every financial milestone and maximize your lifetime customer value.

Customer Intelligence + Journeys = the next generation of customer engagement

Unleash the full potential of marketing automation with dynamic Journeys that leverage data insights from across your tech stack that allow you to deliver truly personalized communications. Now, you’ll never have to wonder if you’re presenting the most relevant products or messages to your audience segments.

Small but mighty. Segmentation helps create more personalized communications.

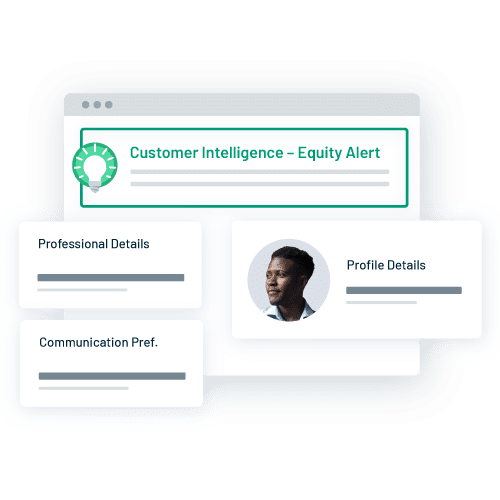

Total Expert Customer Intelligence aggregates data from across your tech stack to help you separate contacts based on almost any criteria: demographics, recent activity, transaction history, financial thresholds, and more.

You can further segment each list by adding inclusion or exclusion rules for entire campaigns or specific emails to ensure that each customer only receives the messages, product offers, or touchpoints that are most relevant to their financial goals.

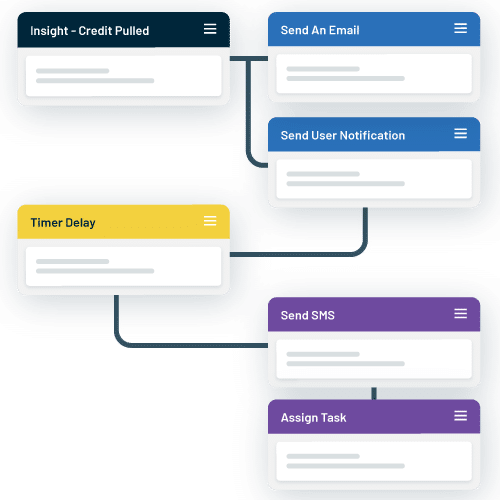

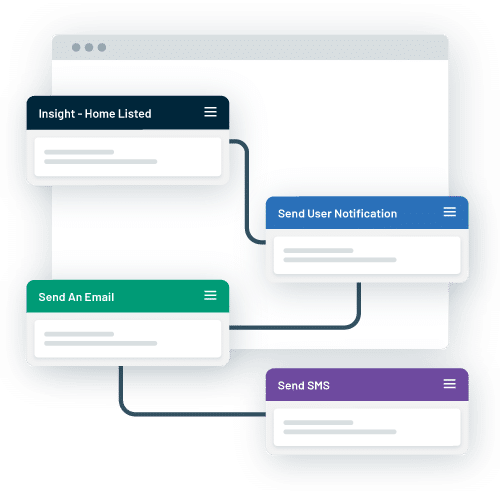

Purpose-built Journeys are a game-changer

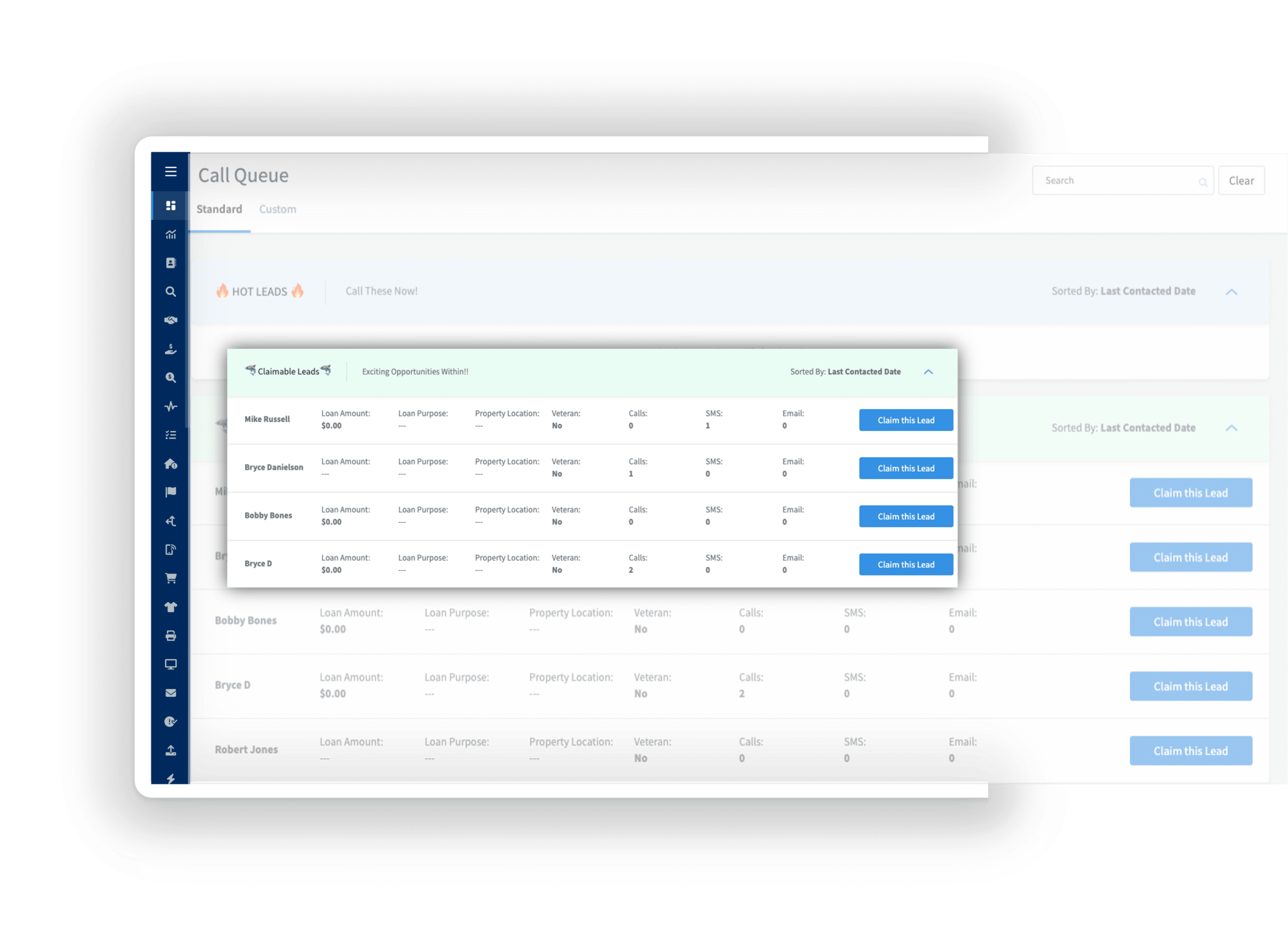

Increase customer engagement and conversion rates with a seamless mix of digital communications and human outreach that keep customers engaged with product information and educational resources that support their financial goals until it’s time for your team to reach out directly.

Save time for your customer-facing teams by leveraging our pre-built Journeys based on industry best practices or modifying them to fit your goals and customer needs. Deliver the next best message, product, or touchpoint with customized Journeys that adapt to each customer’s behaviors and preferences—all with a drag-and-drop editor that anyone can use.

See it in action

We know that seeing is believing. Let us show you the power of Total Expert.

Knowledge & insights

Stay up to date with the latest financial news, industry trends, and Total Expert tips.

Four core alerts

Be ready to act the moment your customers make the next move on their financial journey with four critical activity alerts that help you understand their short-term needs and long-term goals—so you can continue delivering a truly personalized experience.

Know when a lender pulls the credit of any contact in your database so your mortgage team can reach out and keep those customers in house.

Learn when a borrower puts their home on the market so you can engage them as they begin searching for another home.

See when a borrower reaches a combined loan-to-target ratio or could put equity toward a home renovation loan.

Identify opportunities when borrowers qualify for a lower rate that could convince them to refinance.