MORTGAGE LENDING

Create the Personalized Experiences Borrowers Demand

To generate more leads, close more loans, and maximize the outcome of every opportunity, you need digital tools that are purpose-built for modern lenders. Total Expert’s customer engagement and intelligent automation platform improves sales productivity and automates communications to help you deliver the perfect customer journey.

Data doesn’t lie

2x+

Retention rate

Loan retention rates climb to over 60%—more than triple the 18% industry standard.

20%

Year-one revenue increase

Loan production increases 20% per loan officer in the first year and more than 40% by year three.

90%

Adoption rate

Lenders and loan officers love us because we help them prioritize leads and increase efficiency.

20%

Productivity increase

Sales, marketing, and compliance teams work better when they’re aligned on a single platform.

MULTICHANNEL CONSISTENCY

Seamless, scalable customer experiences

Give your loan officers and marketers the digital tools they need—data, insights, automation, and compliance management—to create impact with every interaction across every channel. Total Expert makes it easy to create dynamic multichannel campaigns that combine print, direct mail, email, SMS, and social media to create a smooth, consistent experience no matter how your customers choose to engage.

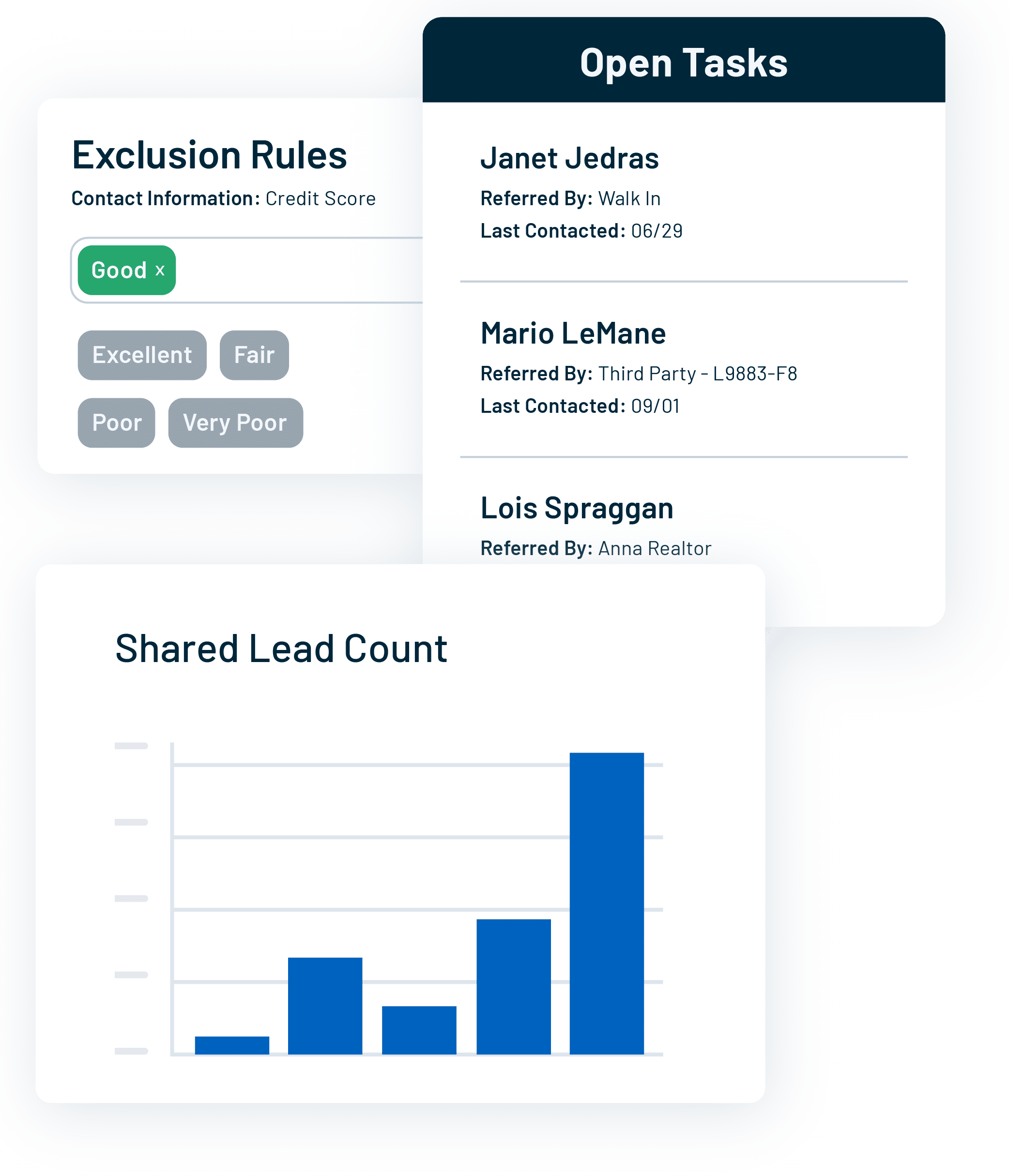

Lead generation & routing

Generate more opportunities by nurturing and expanding your referral partnerships through dynamic co-marketing campaigns. Then, reduce the administrative burden on your teams and help them increase productivity by automatically routing incoming leads to the right loan officer and surfacing high-priority engagements first.

Conversions

Improve application-to-close rates by harnessing real-time data signals and using them to fuel intelligent customer journeys. Built-in customer intelligence will allow you to deliver powerful, personalized experiences based on customer behavior and intent. That makes it possible to create customer journeys that feature the right mix of digital communications and human engagements and provide relevant content when customers signal a need—not just when you think they’re ready.

Post-close

Automate customer engagement after closing to deliver a smooth, personalized experience that develops deeper relationships with borrowers so you can increase referrals and secure future revenue. Leverage always-on nurture campaigns to provide new homeowners with valuable information about their loan (like payment reminders) or encourage them to refer you to friends and family.

Retention

Stay connected with your customers via marketing automation and customer intelligence to capture repeat business and stay one step ahead of your competitors. Our 360-degree customer view pulls in data from your third-party platforms to help you better understand your customers’ financial needs. That data enables critical activity alerts for credit inquiries, property listings, equity thresholds, and rate qualifications to help you know the moment a new opportunity presents itself.

Knowledge & insights

Stay up to date with the latest financial news, industry trends, and Total Expert tips.

Other Resources

From Lone Wolves to a Unified Pack: Why Lenders Need a Shared Platform

Lone-wolf lending may drive short-term wins, but it fractures data, customer experience, and long-term growth. To scale sustainably, mortgage lenders need a shared platform that unifies efforts, empowers every LO, and builds lasting relationships. It’s time to stop scrambling—and start growing—with a strategy built for today’s market realities.

Total Expert Wins a Pair of Awards at North American FinTech Marketing Awards 2025

Total Expert earns recognition in two separate categories for its overall thought leadership strategy and 2024 Accelerate conference.

Total Expert Announces Voice AI Sales Assistant Purpose-Built for Mortgage Lending

Agentic technology helps lenders scale growth and improve customer retention by boosting engagements, conversions, and productivity.