Generate Stable, Organic Membership Growth

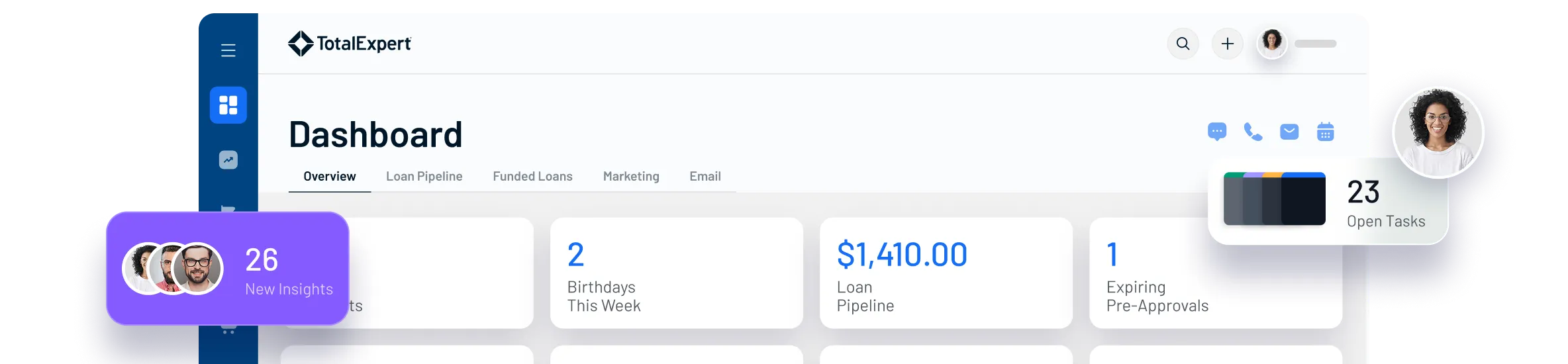

Serve and support your members with the help of purpose-built tools that provide personalized experiences at every stage of their financial journey.

Schedule a demo

powered by Total Expert

THE TOTAL EXPERT DIFFERENCE

Deliver seamless, scalable member experiences

To meet the growing expectations of modern consumers—and keep pace with digital-first FinTech competitors—credit unions need to embrace enterprise-level tools that unite teams across their organization, harness the power of data, and ensure a seamless member experience.

Reduce seasonal declines in member engagement

Peaks and valleys in member engagement rates throughout the year make it difficult for credit unions to maintain product adoption and increase wallet share. Total Expert provides marketing automation tools and pre-built content templates to help keep members engaged and maximize the lifetime value of their products.

Meet the needs of younger members

Generational shifts in how members prefer to interact with their credit union—and how they expect you to support their financial needs—mean embracing tools and technologies that allow you to customize member experiences at scale. Total Expert's dynamic Journeys adapt based on member engagement to help deliver the right message at the right time.

Reduce seasonal declines in member engagement

Peaks and valleys in member engagement rates throughout the year make it difficult for credit unions to maintain product adoption and increase wallet share. Total Expert provides marketing automation tools and pre-built content templates to help keep members engaged and maximize the lifetime value of their products.

Meet the needs of younger members

Generational shifts in how members prefer to interact with their credit union—and how they expect you to support their financial needs—mean embracing tools and technologies that allow you to customize member experiences at scale. Total Expert's dynamic Journeys adapt based on member engagement to help deliver the right message at the right time.

Improve retention after onboarding

Member engagement often plummets after onboarding, leading to challenges with cross-sell and long-term retention. Total Expert helps you keep members engaged by delivering timely, relevant communcations that educate them about their finaicial options and providing personalized products and offers that support their financial needs and goals.

Think beyond table-stakes digital experiences

Our world is always-on and ever-connected, so offering a digital banking for your members is no longer optional. Total Expert helps credit unions stand out in the modern market by providing purpose-built tools to deliver personalized experiences at every stage of your members' financial journey.

Improve retention after onboarding

Member engagement often plummets after onboarding, leading to challenges with cross-sell and long-term retention. Total Expert helps you keep members engaged by delivering timely, relevant communcations that educate them about their finaicial options and providing personalized products and offers that support their financial needs and goals.

Think beyond table-stakes digital experiences

Our world is always-on and ever-connected, so offering a digital banking for your members is no longer optional. Total Expert helps credit unions stand out in the modern market by providing purpose-built tools to deliver personalized experiences at every stage of your members' financial journey.

CREATE BETTER OUTCOMES

Proven results for modern banks

Explore case studies

GROWTH & CUSTOMER LOYALTY

Optimize engagement across the entire customer journey

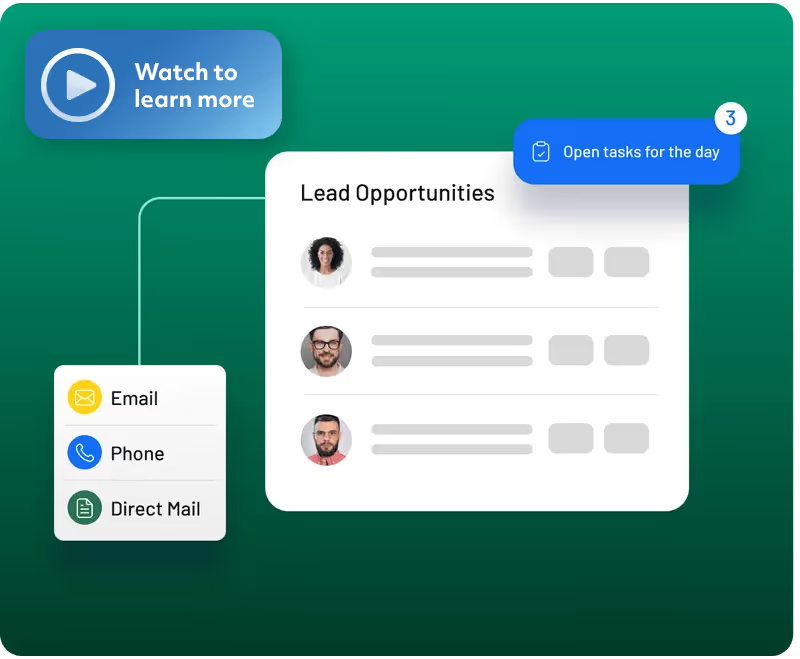

LEAD GENERATION & ROUTING

Generate more loans in any market

Drive consistent deal flow by getting targeted messaging in front of every borrower, then seamlessly guide them through the loan process by quickly connecting them to the right loan officer to support their homebuying needs.

Increase lead volume & quality

Build pipeline through outbound campaigns and co-marketing programs.

Improve application capture

Meet customers where they are and make it easier for them to take the first step.

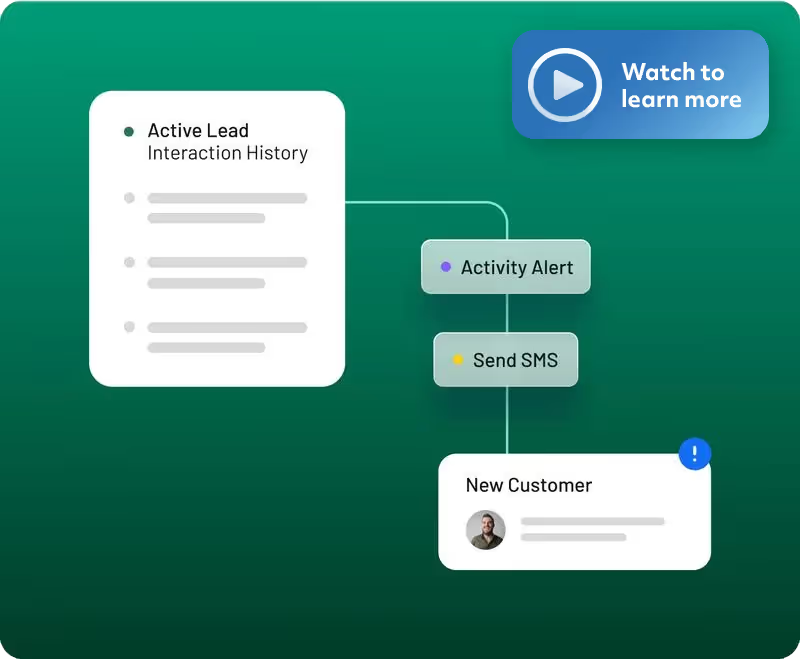

CONVERSIONS

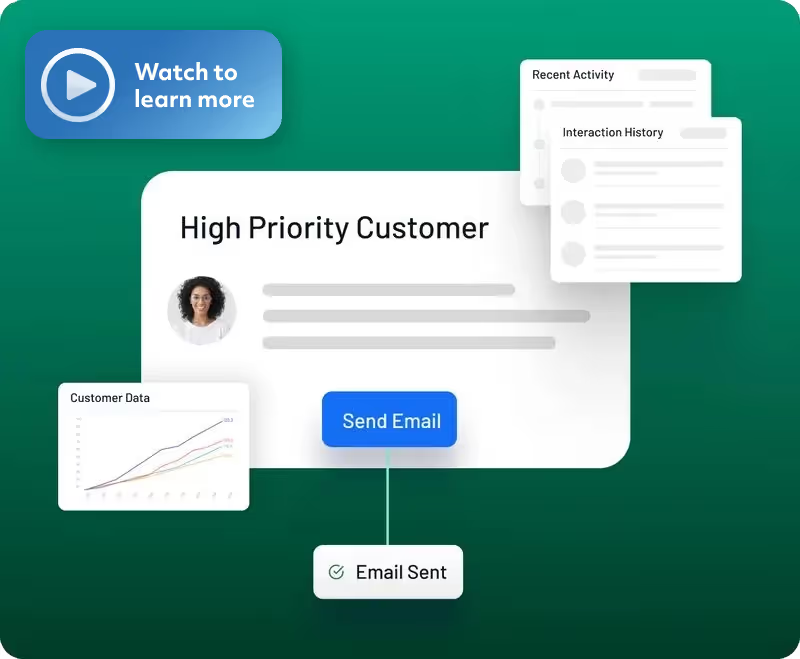

Move from first contact to closed loan

Increase your application-to-close rate by leveraging intelligent automation to create personalized customer journeys that learn from each borrower’s behaviors, adapt to their needs, and support their goals.

Improve application-to-close rate

Stay connected with borrowers at every stage of the application process to make sure opportunities don't slip away.

Boost sales productivity

Quickly identify opportunities to focus on today while automatically nurturing the contacts who aren’t ready to act yet.

ONBOARDING

Start your customers on the right path

Optimize the onboarding experience by balancing automated digital messaging and human outreach to give new customers the information and support they need without overwhelming them.

Consolidate your data

Create a single hub for your customer communications by aggregating data from multiple sources into a single powerful platform.

Automate communications

Deliver a seamless experience across every channel that reinforces your customers' decision to choose your bank.

Increase product usage

Help your customers get the most out your products and services by providing educational content and resources.

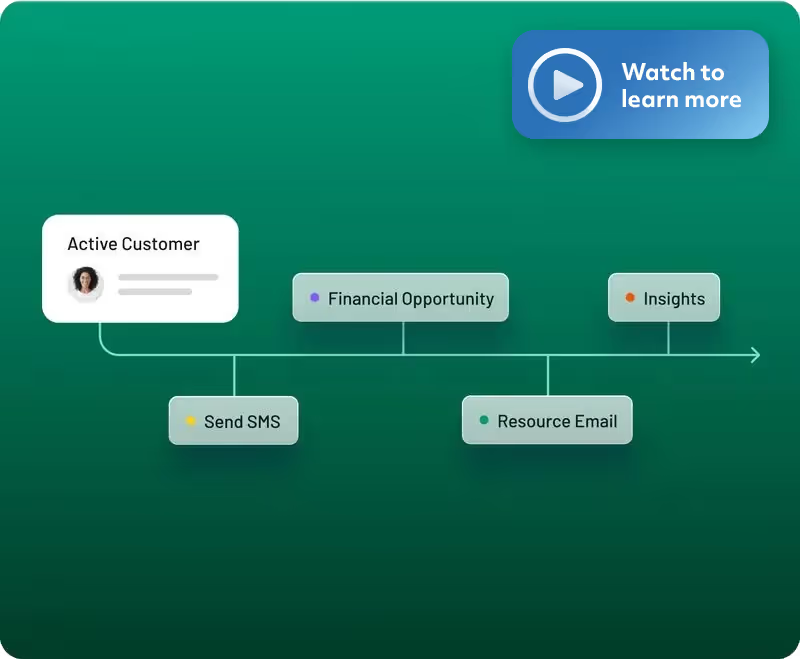

CROSS-SELL

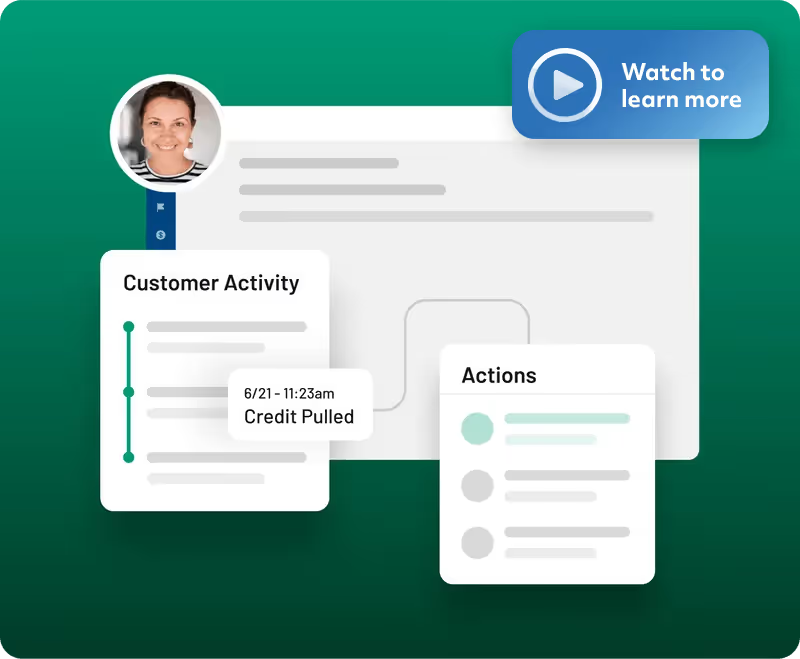

Present the next best product to your customers

Monitor your current customers’ activity so you can stay one step ahead of their needs and connect with them when they’re most likely to enter the next stage of their financial journey.

Increase wallet share

Keep more customers in house by delivering timely, relevant communications based on their finanical needs.

Build relationships

Stay connected with your customers and help them navigate every stage of their financial journey.

Improve segmentation

Quickly divide your contact list to engage customers based on specific financial needs or recent activity.

RETENTION

Today’s borrower is tomorrow’s refinancer

Long-term growth strategies must focus on generating qualified opportunities, maximizing your ROI, and increasing retention. Total Expert turns your database into a deal-flow engine by identifying critical moments to engage customers before they start talking to competitors.

Expand realtionships

Leverage profile enrichment and activity alerts to engage customers about their options for refinancing, tapping equity, or accommodating their growing family.

Generate more referrals

Building your existing relationships is a simple strategy for driving referrals and repeat business.

start today!

Ready to get started?

Schedule a demo

Reviews

Hear it from our customers

Customer Stories

MORE THAN A PLATFORM

We’re here to support your people and your goals

Tools and technology are only as effective as the people who use them. That’s why we provide dedicated support, expert guides, and education resources for every customer—all from a team that’s deeply passionate and knowledgeable about banking and lending.

Services overview

Dedicated Support

Get the help you need from our support and customer success teams.

Professional Services

Make the most of your investment by tapping into a team dedicated to your success out of the gates.

Education & Guides

Elevate your sales and marketing approach alongside a team built to ensure adoption and success.

Resources

Knowledge & insights

See Total Expert

in action

Create sustainable growth and increase loyalty with a customer engagement platform that’s purpose-built for financial institutions.