INSIGHTS + ALERTS

Understand and Anticipate Your Customers’ Needs Throughout the Financial Journey

Continually update your customer profiles with real-time data and insights into their financial activity so you never miss an opportunity to engage them with the advice, education, or products they need—when they need it. No more digging through your database for the best opportunities.

Life Events

Life happens. Help your customers plan for it.

Be ready to act the moment your customers signal intent to make their next financial decision by monitoring your database for key behaviors and leveraging activity alerts that automatically surface opportunities to your customer-facing teams. Combined with our profile enrichment capabilities, you can deliver truly personalized communications to every customer that guide them through every milestone on their financial journey.

Family

Marriage, divorce, new parent, graduation

Home

New mover, listing alert, credit inquiry, equity alert, rate alert, credit improvement

Career

Occupation change, retirement, Social Security

From life event to lifelong engagement

When one of your customers begins planning for—or experiences—a life event, Customer Intelligence will identify and surface those opportunities by sending specific alerts to your customer-facing teams. These alerts provide the critical information your teams need to reach out quickly and have authentic, impactful conversations based on each customer’s short-term needs and long-term goals.

Customer Intelligence aggregates your existing data and enriches it with publicly available third-party data to help you create dynamic customer profiles and ensure your digital communications and human outreach are always timely, relevant, and hyper-personalized—establishing your organization as a trusted partner for life.

Mortgage credit inquiry alert

Credit checks are usually the first sign that someone is serious about buying a house or refinancing. Our mortgage credit inquiry alert tells you when a competing lender pulls the credit of any contact in your database so your mortgage team can connect with that borrower before it’s too late.

Know: Receive an alert the moment a bank or lender pulls the credit of any contact in your database.

Act: Engage those contacts with automated digital communications and direct loan officer outreach to discuss their needs and goals.

Deliver: Get the jump on your competitors by offering borrowers a better product, rate, or terms.

Alerts Powered by Equifax:

We’ll help you link your database to the Equifax network, so you’ll never have to question if a customer is serious about their borrowing intentions.

Firm Offer of Credit (FOC) Compliance:

We can deliver a dynamic FOC on your behalf to ensure that your organization complies with industry regulations related to consumer credit reports and activity.

Pre-Built Journeys:

Once you receive a Mortgage Credit Inquiry alert, our platform will automatically add that customer to a customized Journey that delivers targeted digital communications and notifies your loan officers to reach out directly.

Equity enrichment + alerts

As homeowners build equity in their property, they unlock more opportunities to leverage it for their financial needs. Total Expert Customer Intelligence enriches your customer records with equity information, giving your lenders the ability to have more informed conversations with borrowers. Because equity alerts notify lenders the moment a borrower reaches an equity threshold, they can deliver proactive communications that present the borrower with detailed options for leveraging their equity, including:

- Cash-out refinances or home equity products for home improvements, medical bills, or debt consolidation

- Reverse mortgages for homeowners ages 62+ needing additional income sources

- Mortgage insurance removal

Know: Create segmented lists for targeted communication and receive notifications when a past customer reaches a predetermined loan-to-value threshold.

Act: Engage those contacts with personalized communications about their options for a home equity product, cash-out refinance, or other relevant offer.

Deliver: Build customer trust and loyalty by educating them on their options and helping them reach their homeownership goals.

Real-Time Loan Valuation:

We calculate the homeowner’s current loan-to-value based on a weekly valuation of their property and the estimated mortgage balance.

Set Your Alert Threshold:

You can set and adjust the loan-to-value threshold that triggers notifications to loan officers for when they should reach out to discuss the homeowner’s options.

Personalized Journeys:

Once a contact reaches the loan-to-value threshold, you can add them to pre-built Journeys that deliver relevant content based on the mortgage products they qualify for. Loan officers can also reach out to targeted segments with relevant information based on specific equity data.

Listing insights

When someone lists their property for sale, there’s a good chance they’re in the market for a new one. Total Expert Customer Intelligence monitors the MLS and your customer database to identify opportunities for your team to help them find their next home.

Know: Get a notification whenever a past customer lists their property on the MLS

Act: Reach out to those customers with a combination of digital and human communications to see if they have plans to buy another property.

Deliver: Help the homeowner simplify the process of selling their current home while searching for their next one by working with a lender who they already know and trust.

Focused View

Quickly sort and segment contacts based on their needs or your business goals to have the most impactful conversations with priority contacts.

Automated Journeys

Move contacts into a customized journey to engage them at this critical moment and present them with options for their next mortgage.

Credit improvement alert

Don’t write off the 34% of applicants whose loan applications are denied due to poor credit. Provide ongoing, automated education and guidance to these future borrowers while monitoring their credit. Once their credit improves to a satisfactory level, your team will receive an alert to reach out and restart the conversation around helping them find a home.

Know: Receive an alert when a past prospect has improved their credit and could now be eligible for a mortgage.

Act: Empower your loan officers to reach out directly and present the good news about the borrower’s credit.

Deliver: Build trusting, lifelong relationships by showing your commitment to helping consumers progress on their financial journey.

Alerts Powered by Experian

We’ll help you link your database to the Experian network, so you’ll receive the most up-to-date information about contacts who have improved their credit.

Firm Offer of Credit (FOC) Compliance

We can deliver a dynamic FOC on your behalf to ensure that your organization complies with industry regulations related to consumer credit reports and activity.

Pre-Built Journeys

Nurture these contacts with educational content for how to improve their credit. Once they reach a predetermined credit score, Customer Intelligence will automatically place them in a Journey that actively guides them toward homeownership with.

Rate enrichment + alerts

The housing market alternates between buyers’ and sellers’ markets. Our rate enrichment and alerts will help you identify opportunities when homeowners qualify for a lower rate so your team can engage them about exploring refinancing options.

Know: Automatically identify past customers who could benefit from a refinance based off their original loan rate and the current market rates.

Act: Move those customers to a targeted nurture campaign that educates them about their refinancing options and keeps them engaged until they’re ready to act.

Deliver: Build and nurture lifelong customer relationships by helping them save money and make the best decisions at every stage of their financial journey.

Filter by Loan Term

Pull and compare rates for each customer based on both 15- and 30-year conventional loan rates.

Set Minimum Rate Benefit

Set and adjust the minimum threshold for when your loan officers will receive a rate alert to ensure they’re engaging contacts with attractive offers.

Post-Close Grace Period

Choose how long you want to wait after a customer’s loan closes before you receive rate alerts tied to their account.

See it in action

Let us show you the power of a purpose-built customer engagement platform.

How We're Different

Support customers throughout their financial journey

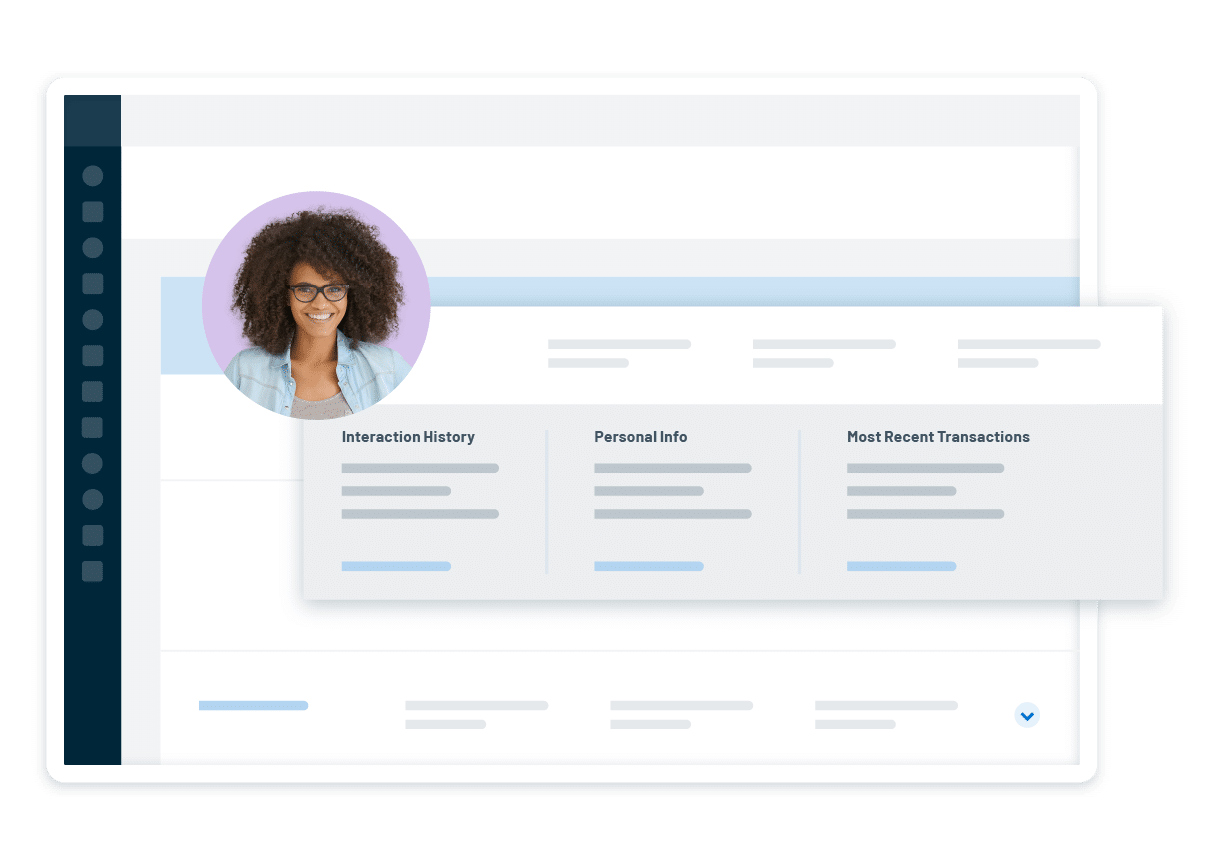

360-degree customer view

Access complete contact profiles from a single platform to increase engagement at precisely the right time in a customer’s unique financial journey.

TrueIntent insights

Understand where consumers are in their financial journeys with foundational CRM, behavioral, and motivational data.

Segmentation

Segment your contact lists to deliver tailored messaging in every campaign.

Prioritized lead & contact lists

Engage critical contacts at the right time without hunting through your database.

Always-on nurture

Develop relationships with customers even if they don’t have a need for your products today.

Multichannel campaigns

Meet customers where they are with tailored campaigns across print, direct mail, email, SMS, and social media.

Digital content & social media

Connect with customers on their schedule with dedicated tools and content for your website, landing pages, and social channels.

Co-marketing campaigns

Increase referrals with integrated co-marketing campaigns that expose your brand to new audiences.

Reporting & dashboards

Track campaign performance, analyze what works, and identify gaps to boost ROI.

Knowledge & insights

Stay up to date with the latest financial news, industry trends, and Total Expert tips.

Four core alerts

Be ready to act the moment your customers make the next move on their financial journey with four critical activity alerts that help you understand their short-term needs and long-term goals—so you can continue delivering a truly personalized experience.

Know when a lender pulls the credit of any contact in your database so your mortgage team can reach out and keep those customers in house.

Learn when a borrower puts their home on the market so you can engage them as they begin searching for another home.

See when a borrower reaches a combined loan-to-target ratio or could put equity toward a home renovation loan.

Identify opportunities when borrowers qualify for a lower rate that could convince them to refinance.