We all talk about “pivot to purchase” by 2022, but do you really know how huge this pivot is, and how to keep your business growing? Below I cover three things to add to your realtor and customer playbook.

Latest ‘Pivot To Purchase’ Stats

In the third episode of our Playbook Series with The Basis Point, we discussed how you must remain focused on the purchase market even as rates stay low in 2021.

Removal of FHFA’s adverse market fee and spreading COVID Delta variant caused rates to drop this past month, which (on 7/21/21) caused the MBA to add $102 billion in refis for 3Q21 and $27 billion for 4Q21, which is great!

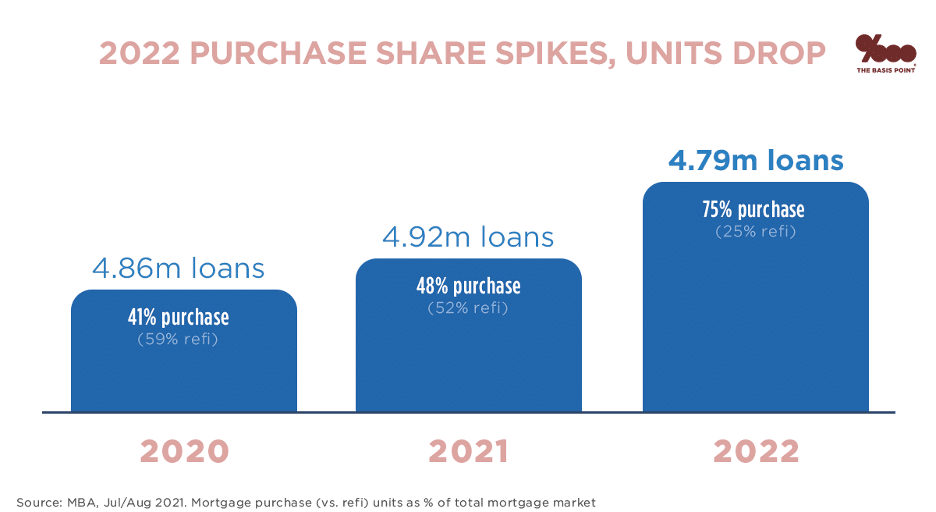

But we’re still squarely in a purchase market by 2022. Here’s a look at the purchase market transition by units. The takeaway: as refi units drop from 5.43 million to 1.58 million next year, purchase units go from 48% to 75% of the total market opportunity.

Playbook 1: Keep “Focused View” On Purchase Customers

Here’s the bottom line: Of the roughly 7 million new and existing homes that’ll sell in America this year, just under 5 million will be financed. If we divide this number by today’s 583,506 licensed bank and nonbank loan officers, it’s only 8 purchase loans per loan officer.

Market research firm Forrester last year noted that lenders using Total Expert to orchestrate their customer journeys are doing 6 more loans per loan officer per year.

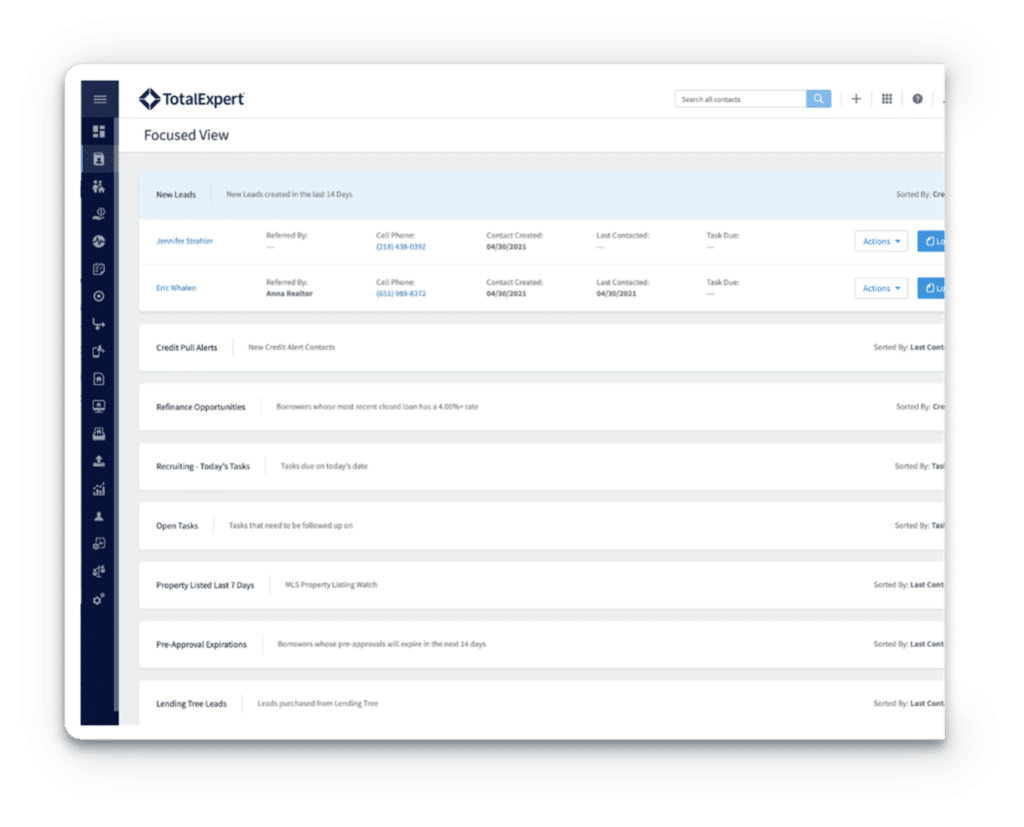

One key driver of this is Focused View, which is a dashboard your loan officers see every morning prioritizing specific outreach tactics based on each customer’s data. This enables immediate 1:1 conversations, task organization, and follow up activities.

This follow up is critical in a market where the NAR reports it takes a borrower 8 weeks and 9 homes before they find the home they bought.

Playbook 2: Know Your Target Realtors’ Stats

Another notable NAR 2021 stat is that 88% of homebuyers found the home they bought through a real estate agent, which means your realtor partners control the deals.

But do you have real-time data on their deals to monitor if they’re loyal to you?

With Total Expert in 2022, you do. This is something I’m especially excited to deliver for your purchase arsenal, and it’ll do a few things for you:

- Target realtors by city, real estate office, and individual agent

- See which lenders that real estate agents are working with and how much volume and units they’re doing with each loan officer

- Set up outreach campaigns to those real estate agents to keep them coming back to you

Playbook 3: Run RESPA-Safe Realtor Partnerships

Winning the purchase game in 2021-22 requires flawless RESPA compliance while also giving your salesforce creative freedom to market to and with realtors.

This will be harder next year than last year as the CFPB tone has changed.

In October 2015, the CFPB issued a now-famous compliance bulletin strongly admonishing joint lender/realtor marketing. Then a new administration rescinded that bulletin in October 2020. Now the current administration’s CFPB has sent similar signals as the 2015 era.

Political signals change, but RESPA compliance is permanent. That’s why Total Expert’s realtor/lender co-marketing platform automatically manages RESPA compliance for you.

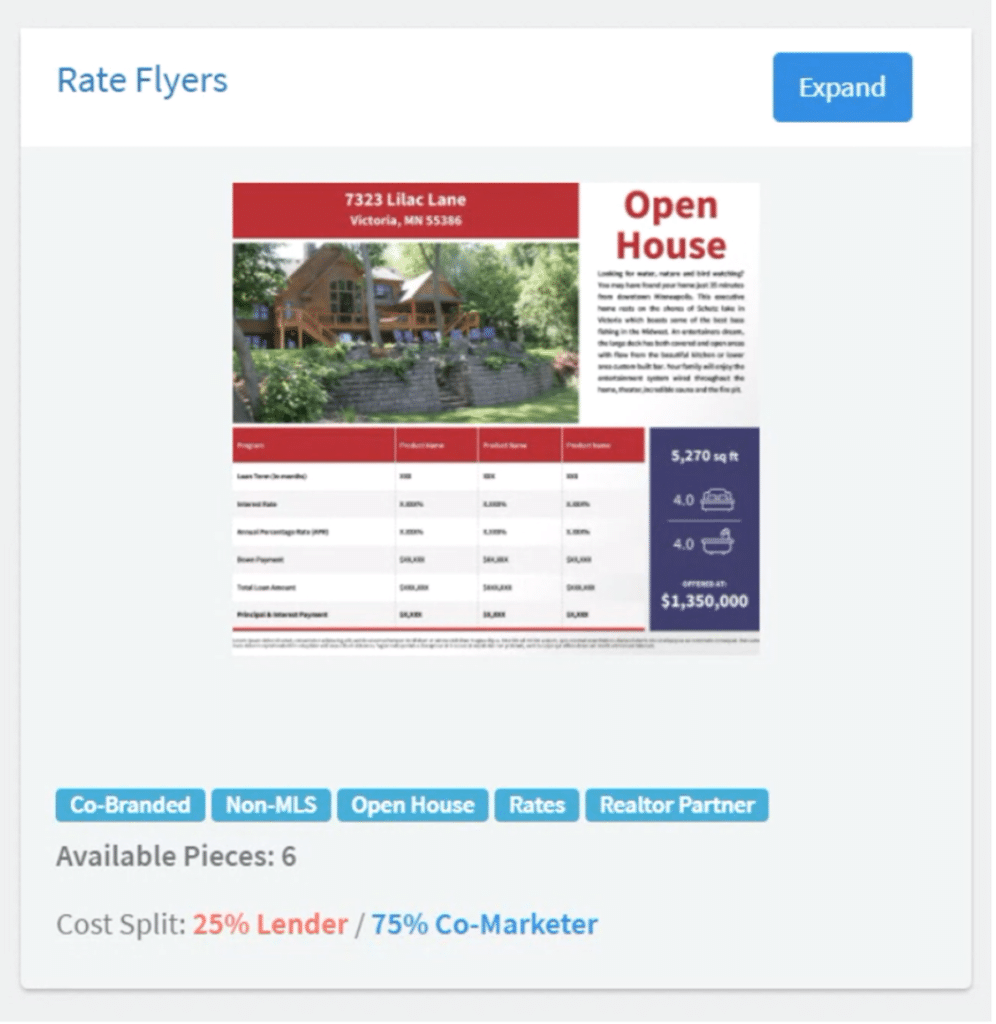

The below image is a sample of a co-branded rate flier your loan officer can create for their realtor in seconds (with connections to MLS and your pricing engine), and the system automatically calculates and administers a RESPA-compliant cost split and audit trail.

Total Expert powers this for every kind of digital and print marketing asset at scale for your entire salesforce. This gives you creativity, engagement, speed, and compliance needed to win in today’s hyper-competitive purchase market and strict consumer protection environment.

Stay tuned as Total Expert and The Basis Point give you more diversification playbooks during summer and fall 2021.