America’s mortgage refi market has 1.98 million more units for lenders now than when 2021 began, but refis still drop very sharply next year. Below, we cover three refi playbooks that enable you to win refi market share and deliver the ultimate refi journey. Let’s start by looking at the market shift that’s coming.

Latest Refi Stats

In our LinkedIn Live session, we discussed how 2021 has turned out to be a great refi year but 2022 is the opposite. As 2021 has progressed, rates dropped and refi projections rose in reaction to persistent COVID economic risk and removal of FHFA’s adverse market fee.

Current MBA projections call for $1.9 trillion of refi volume this year, which is 19% less than $2.4 trillion last year, but is $790 billion more than the MBA’s January 2021 refi projection.

Now let’s look at refi units to see how many actual refi deals are available to you. Last year’s HMDA data showed 9.18 million refi units closed in 2020. If we divide these refi units by 262,284 licensed loan officers who closed refis last year, that’s 35 refi closings per loan officer.

The MBA predicts 2022 refi units will be down 78% compared to 2020. If true, this would mean there’s only 8 refi closings per loan officer in 2022.

With this in mind, let’s cover three refi playbooks to improve customer journeys and win more market share: (1) speed and precision on rate/term refis, (2) the golden age of debt consolidation, and (3) capturing the home improvement trend.

Playbook 1: Speed & Precision on Rate/Term Refis

Per MBA estimates, there have been about 2.83 million home purchase units funded in America so far in 2021 (January to July), and rates were 0.25% to 0.375% higher in four of these 7 months. To target rate/term refis for these folks, you need 4 things: precision borrower targeting, real-time rate comparisons, early payoff (EPO) risk analysis built in (to avoid fee recapture for refinancing purchase loans closed in the last 180 days), and automated engagement for each individual borrower profile.

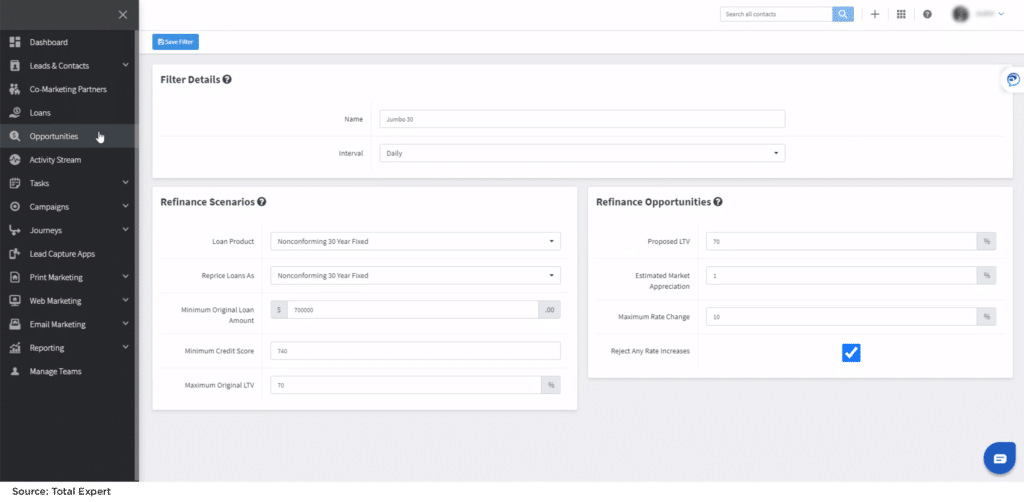

Below is a two-step process showing how Total Expert’s real-time data enables fast action for your salesforce and your customers.

The below shows a Total Expert Opportunities tool that lets sales teams target and filter borrower refi scenarios in real-time. It’s tied into the pricing engine for each loan officer’s pricing so the quotes are precise, and some Total Expert customers configure it to screen out EPOs to control costs.

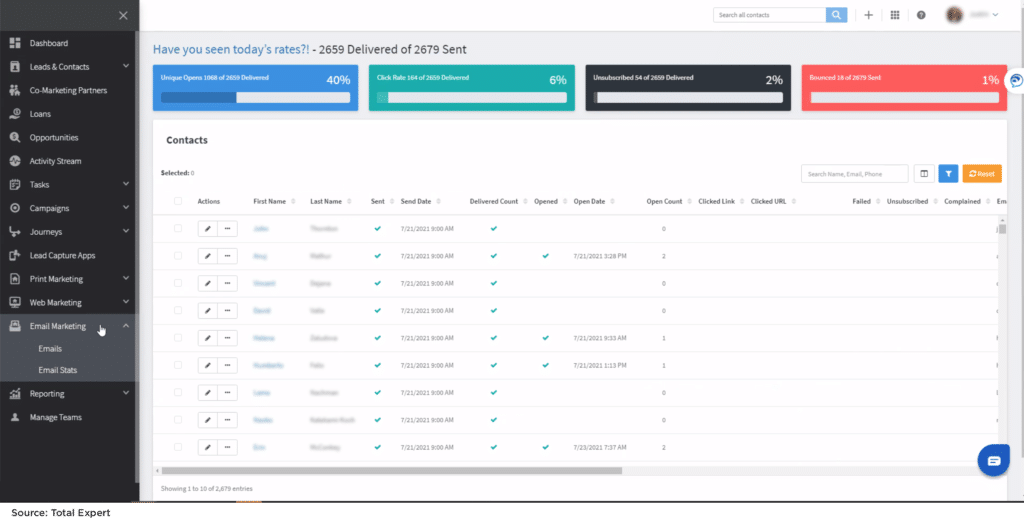

The second image shows the importance of an automated, personalized customer journey to make your salesforce productive. After your loan officers filter their refi targets, outreach can be automatic based on how you configure. This example shows a refi email campaign deployed, campaign analytics in real time, and customer-level lists so your team can engage with each customer as they interact with campaigns.

This is how you can power your salesforce to develop an entire refi pipeline by pushing a few buttons.

Playbook 2: Golden Age of Responsible Cash Out Refis

We’re now entering a golden age of responsible cash out refis for a few reasons.

First, according to Black Knight, U.S. homeowners now have an all-time record of $8.1 trillion in tappable equity (which means equity that can be taken out before exceeding 80% combined loan-to-value ratio).

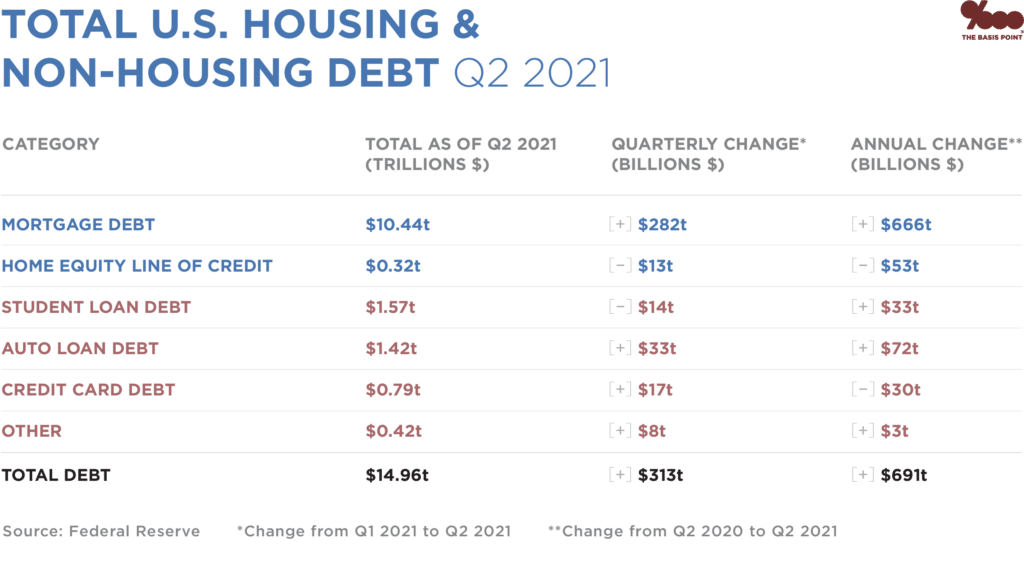

Second, non-housing debt is now double its 2004 levels at $4.19 trillion, as shown in the table below. This student loan, auto loan, credit card, and other debt (personal loans, etc.) mostly has higher rates than mortgage rates. Because of record equity, many borrower profiles can consolidate this debt into a new mortgage without creating loan-to-value ratio risk for themselves or the housing system.

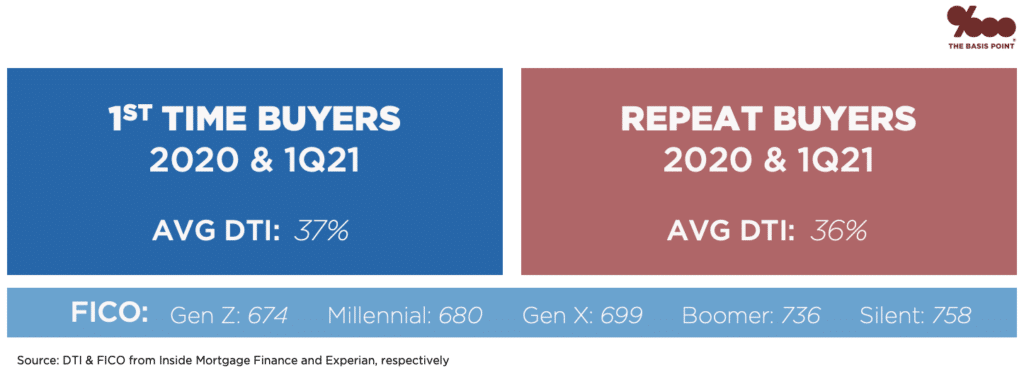

Third, borrower profiles are very strong overall. The below table shows that debt-to-income ratios of recent homebuyers are in the 36 – 37% range, and credit scores of millennials, Gen X, and Baby Boomers are all favorable. In many cases, debt consolidation actually improves these profiles because moving higher rate non-housing debt to housing debt lowers monthly costs, and improves credit scores.

Debt consolidation is truly one of the ultimate customer journeys for 2021-22, and Total Expert powers you to target debt consolidation customers.

Playbook 3: Powering the Home Improvement Trend

Total Expert powers you to engage your customers using their homes, and take immediate action based on how people are engaging with their homes.

People’s emotional connections are with their homes, and according to the Harvard Joint Center for Housing Studies, homeowners will spend $433 billion on home improvement this year.

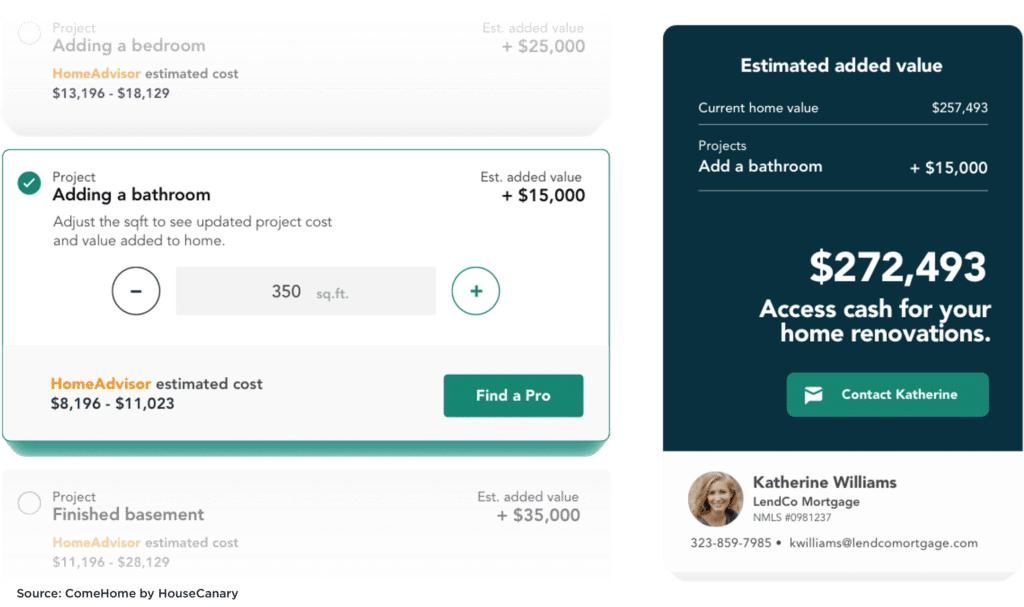

We integrate many valuation/home engagement tools, and the example shows how you can power instant remodel planning, and make loan offers at the same time.

The great part about this is that even if your customer didn’t click on the loan officer contact button when modeling out home improvement ideas, their actions still carry into Total Expert, so you can choose to create automated journeys to follow up on these actions. Or you can create alerts and/or Focused View daily to-do lists for your loan officers to follow up with customers on these actions.

Through these three playbooks, lenders can win refi market share and deliver the ultimate refi journey.