Growth is the key driver of high performance for credit unions, according to analysis by Raddon. No big surprise there for any financial leader, but how did they find growth? And how do members, and credit unions’ relationships with them, play in?

Raddon found high-performing credit unions excelled at widening member usage of their products and services, managed higher ratios of profit-contributing households, garnered more risk-free revenue from fee income, and grew revenue without drastically scaling expenses.

Garnering Growth and Profitability

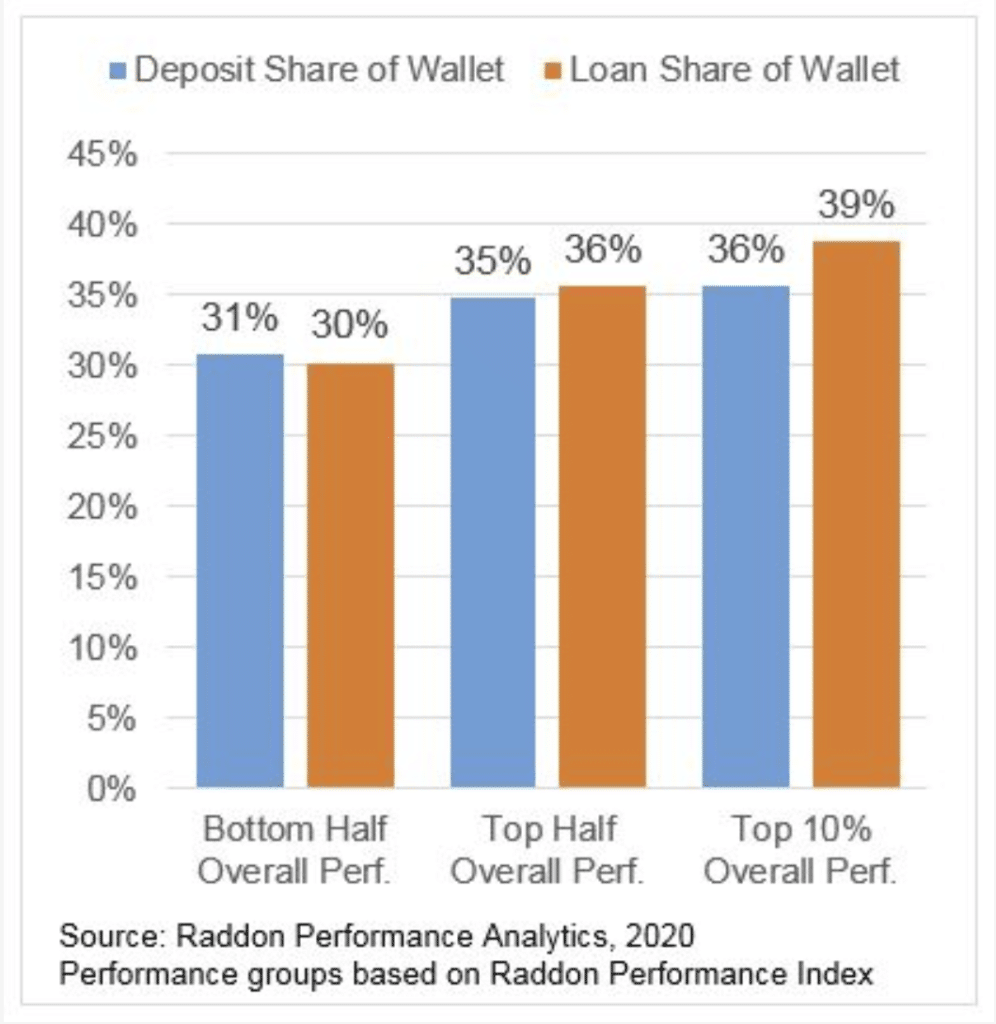

Helping members with a greater portion of their financial needs has clear correspondence to high performance and growth. The top 10% of credit unions were nearly 20% more likely to earn higher deposit and loan balances from members than others in the top half. If that seems like a slim advantage consider that those in the top 50% were 120% more likely than those in the lower 50% to grow deposit and loan relationships.

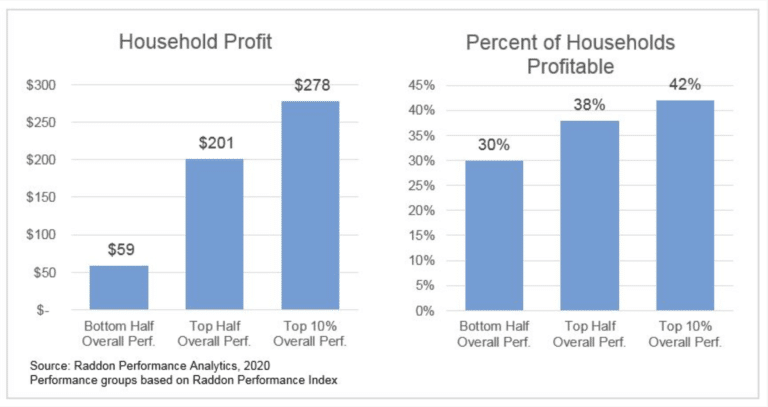

Profitable households also subsidize far fewer unprofitable households at top performers. Whereas at lower-ranking credit unions, only 30 percent of households were profitable – the remaining majority of their members do not generate enough margin income or non-interest income to offset the costs of servicing their accounts. While even top performers still subsidize the majority (58%) of households, profitable households make up 40% more of their member base compared to the bottom 50% of the institutions.

Relationship Builders

High performers received significantly greater shares of members’ deposits and loans.

For example, at high-performing institutions, nearly four out of 10 (39%) of member households’ total loan balances were with the institution, with the remaining 61% assumed to be with competitors.

In contrast, the bottom half of credit unions garnered only 30% of members’ total loan balances – a 30% shortfall compared to their peers.

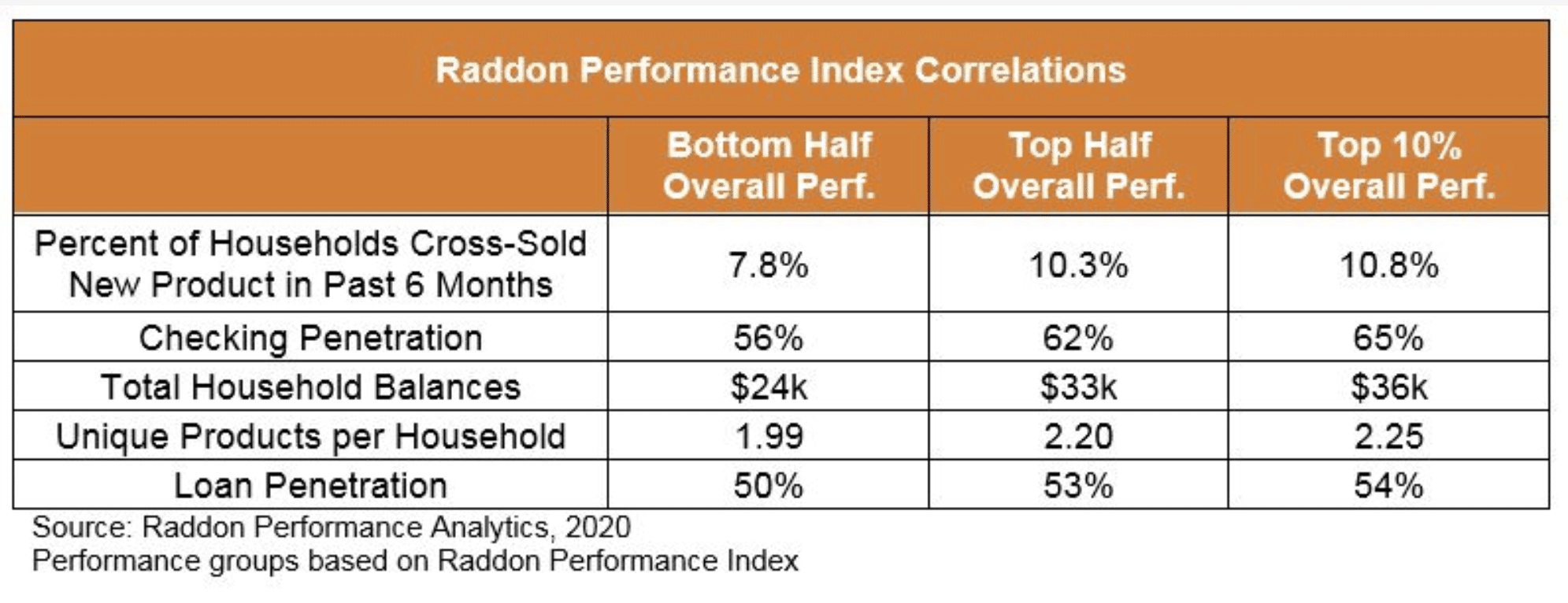

High performers also depended on broader member utilization of their products and services. Notably, the top 10% of credit unions “cross-sold” a new product to 10.6% of their membership within the past six months. The cross-sell rate declines by nearly 38.5% for lower-ranked credit unions to 7.8%

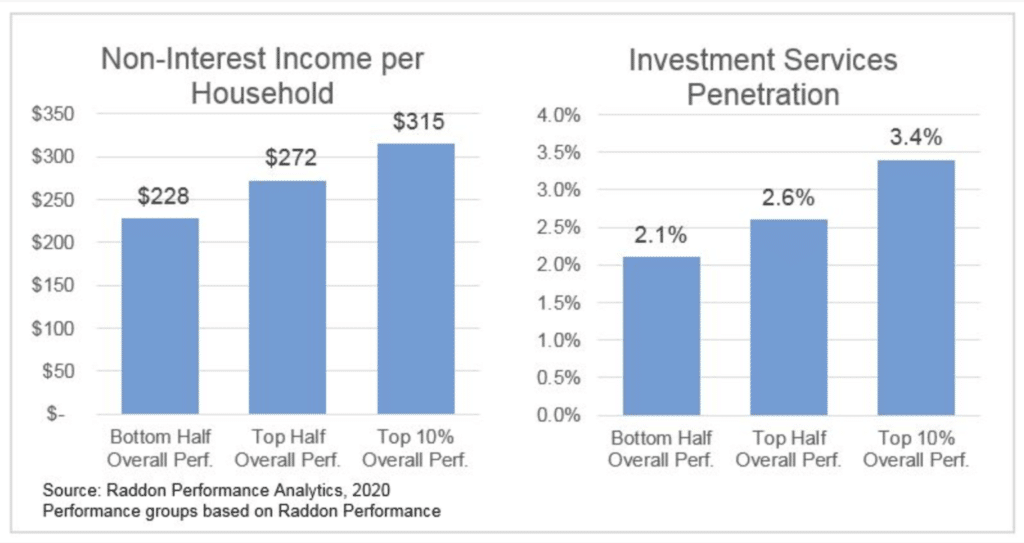

Performance is a function of a credit union’s ability “to develop deeper member relationships,” Raddon reported. Aside from the number of services used by a member, deeper relationships meant greater usage of products and services that generate non-interest income.

More fee revenue, though, was not necessarily about having more fees or higher fees, “it is the reflection of having stronger consumer engagement and more diversified sources of non-interest income,” Raddon analysts wrote.

When an institution is good at widening member use of its services, it is far more likely to provide members its investment services, which generate more fee income than other services. More robust levels of checking penetration offer non-interest income opportunities as well (see the table above), such as debit and credit interchange revenue. These fee sources also are not double-edged swords. They generate non-interest incomes without taking money from members’ accounts in a way they perceive as punitive.

High-performing credit unions earn 38% more non-interest income per household than their counterparts.

Scaling and Efficient

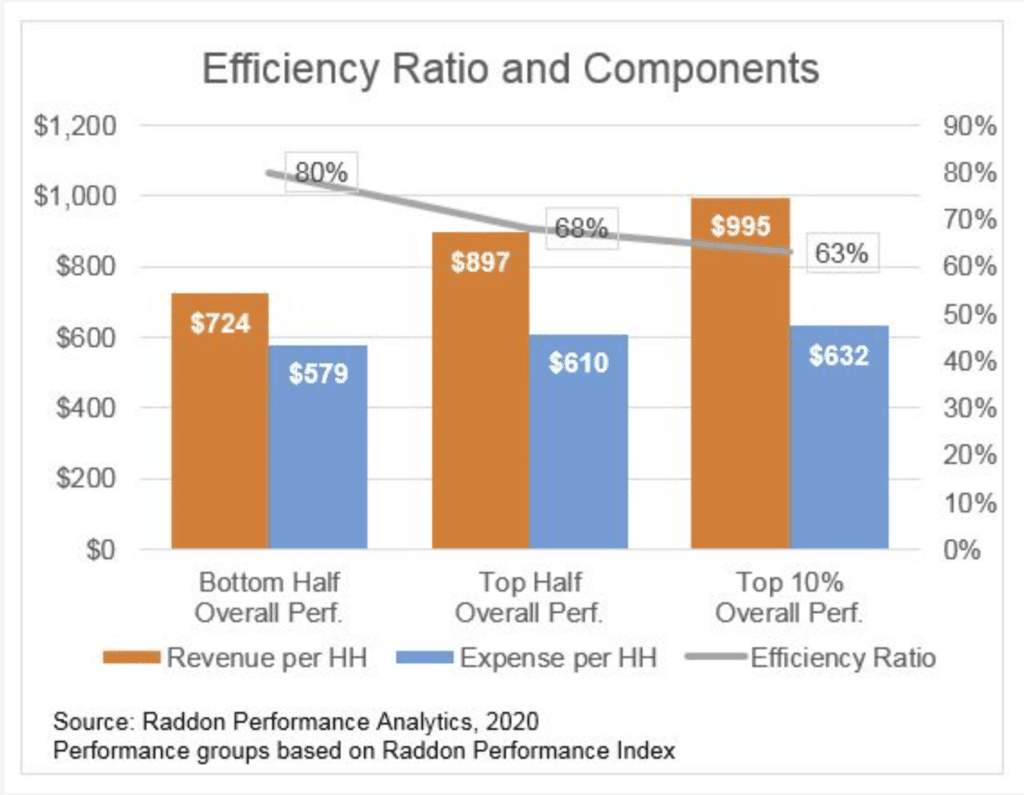

High-performers are more efficient than peers.

Calculated as total expenses as a percentage of total revenue, efficiency comes from reduced expenses, increased revenue, or a combination of the two. As the adage says: You can’t cost-cut your way to growth and profitability. High-performers do control costs, but their efficiency comes from generating significantly higher levels of revenue per household relative to their costs. They show credit unions are better off earning their way to better efficiency than simply cutting costs.

“For most organizations, expenses can be reduced by only so much before the reduction has an impact on service levels or growth opportunities,” Raddon explained in its report. “Deposit rates can be cut by only so much before the cost of funds hits a virtual floor.”

Because revenue is 37.4% higher at high-performers, they are still more efficient than their peers, even though they spend 9% more.

High-Performance Road Map

Credit unions need to follow the roadmap of high-performing credit unions, especially as interest rates and economic conditions change. Rising interest rates offer opportunities to grow earning assets at a higher margin, even while economic conditions may or may not support loan growth. Improving at serving current members for all borrowing needs – especially those that overlap with the institution’s offering – insulates growth in challenging economics, and supports more growth in favorable environments.

The story is similar for cost of funds and margin, loan growth becomes even more valuable when institutions stave off margin pressures from deposit price competition. When credit unions manage deposit retention and growth at an acceptable cost relative to their asset-liability strategies, greater profitability is within reach. Non-interest income also is the single best protection for profitability in times of margin compression.

As credit unions win consumers over – especially when they begin to see the credit union as their primary financial provider (PFI) – they become true members. Rather than simply keeping a share account, they use the institution for major financial milestones. When every major tactical contributor to high-performance is member relationships – their depth, profitability, and efficiency – leaders need to make building those relationships their focus.

This article is edited and republished with permission from Raddon, a Fiserv Company. The findings reported are results published by Raddon for its Crystal Performance Award, an annual recognition for credit unions.