Few topics generate the combination of instant interest and underlying apprehension as generative artificial intelligence (GAI). In the insurance industry—much as across the business world—people are buzzing about the potential of GAI while feeling anxious that they’re the only ones who don’t understand how these tools can be applied.

Total Expert recently hosted a webinar with over 130 P&C leaders aimed at addressing this gap between excitement and understanding. We dove into several real-world use cases, showing how leading insurance organizations are already using GAI—most specifically to scale up more personalized, relevant, and perfectly timed marketing and sales communications.

The webinar also included a handful of interactive questions. The responses provide some great insights into the root of the excitement/understanding disconnect—and where we go from here:

Insurance leaders know AI has big potential

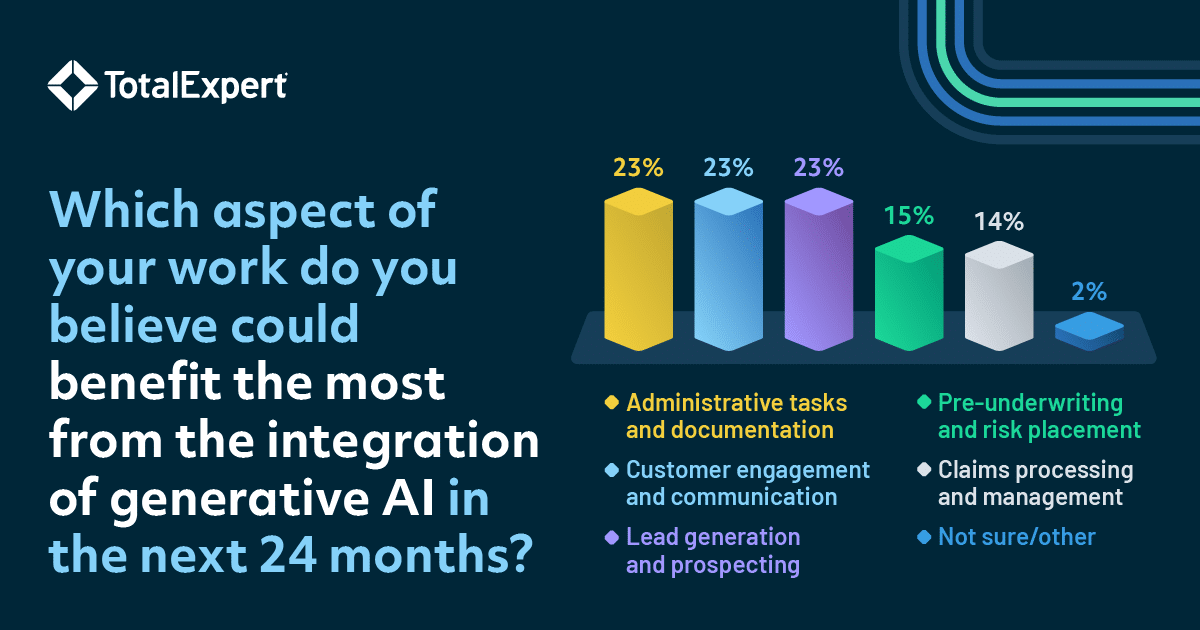

We’ve started to move from the general notion of “AI will change things” to a more refined understanding of which things AI will impact. But our poll responses show that this manifests more as “AI will change everything.”

Insurance leaders see the wide-ranging potential applications of GAI within their business—ranging from offloading the burdens of monotonous everyday administrative tasks, to use cases that promise to more directly drive business value: GAI will power smarter lead generation and prospecting, helping insurance organizations find “lookalike” net-new audiences. GAI will also change customer engagement and communication, enabling insurance organizations to harness the tremendous amount of customer data they must generate more personalized, relevant and useful messages.

Most aren’t yet using GAI tools

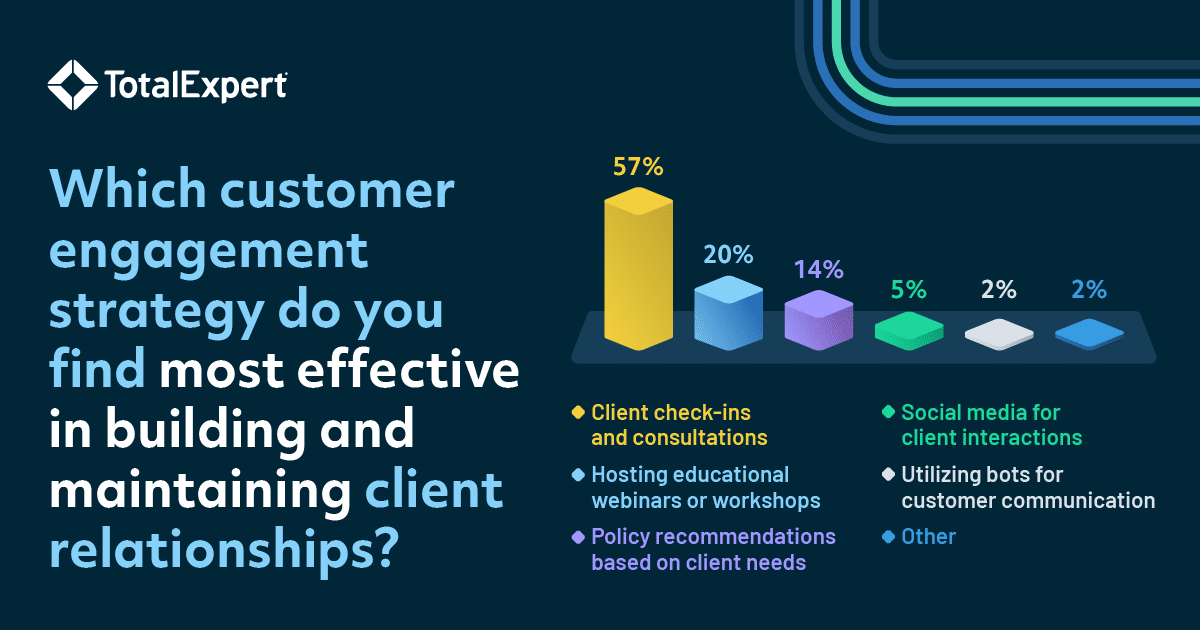

So, are insurance organizations using GAI for all the exciting use cases detailed above? For the most part, the answer is “no.” For example, despite seeing the potential of GAI for customer engagement and communications, attendees said they’re still primarily reliant on client check-ins and consultations—one-to-one engagement between clients and agents.

To be clear, this is an extremely effective way to connect with customers. The challenge is scaling: When you’re juggling dozens or even hundreds of clients, it’s hard to find time to talk to all of them. Moreover, how do you time those one-to-one interactions right—and go into them with the right information to be more helpful?

GAI will help address this scaling challenge on several fronts, like enabling insurance organizations to locate the signals among the noise in customer data—recognizing and even anticipating customer needs. GAI will be able to automatically build out multi-channel, multi-touch campaigns tailored to a specific customer and their identified (or anticipated) needs. And GAI can also automatically generate hyper-personalized messages to fuel those campaigns. Finally, GAI will empower agents with all the information they need—including alerts on when to call—so they can make the best use of their time and skills to reach out with that personal, human touch at the exact right time.

The barrier: Insurance leaders aren’t comfortable with GAI

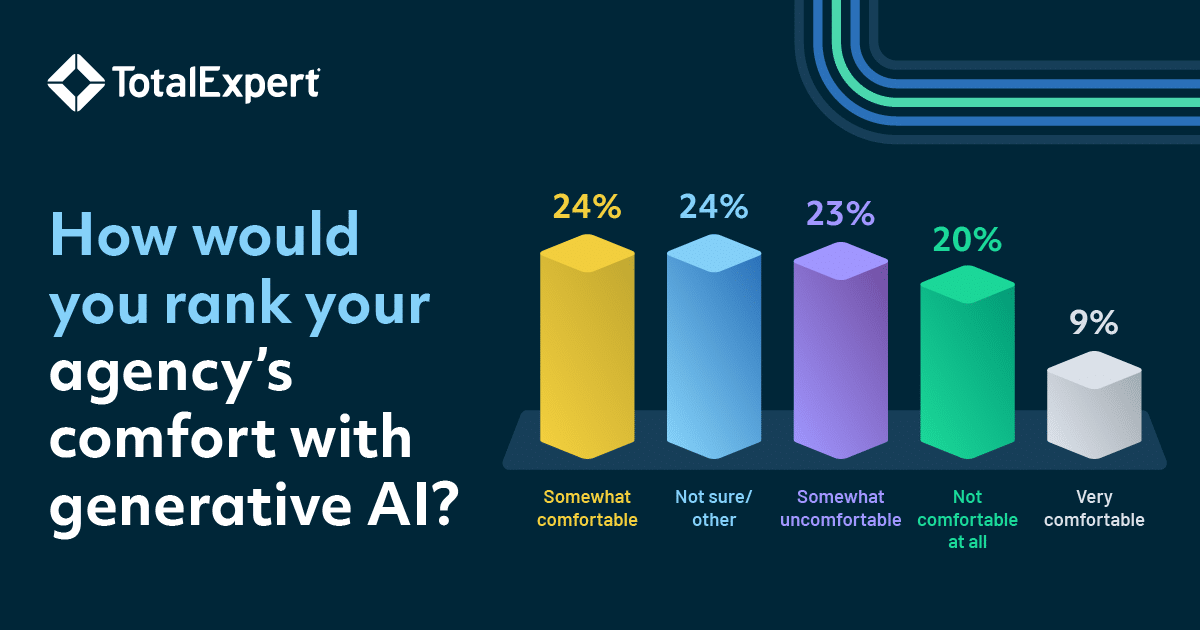

What’s holding insurance organizations back from using GAI tools? They’re not confident or comfortable with how to apply the technology. Our survey showed only 1 in 3 said they’re at least somewhat comfortable with GAI—and just 9% said they’re very comfortable.

There’s no denying that insurance is traditionally a conservative, slower-moving industry. And it’s hardly a surprise that businesses built on mitigating risk are rather risk averse. But in this case, it’s not so much about the data security or privacy risks posed by AI. It’s more a matter of simply not knowing where and how to put these tools to work within business operations. Insurance leaders are wary of the risk of spending time and money on technology and ending up without much to show for it.

Closing the comfort gap

If you missed the conversation, we put together a short eBook covering that same content: How AI Is Transforming Insurance Marketing. The eBook covers the main applications for AI within insurance organizations and why marketing and sales provide some of the richest opportunities—both quick-win impacts and big-picture benefits that will give early adopters a massive competitive edge in the coming years.

No matter where your organization is on the comfort scale with GAI, now’s the time to start thinking about which of the proven applications would be most valuable within your organization. Even if you’re not yet ready to start using GAI tools, the eBook shows you why it’s critical that you start getting the “fuel” for those AI engines ready: understanding what “enriched data” is, why it will be critical to AI success, and what you can do now to prepare.

Connect with one of our insurance experts to let us know where your organization sees the most promising applications of GAI and learn how you can start incorporating it into your workflows.