The widespread adoption of digital banking technology has not erased the long-running gap between the experience financial institutions believe they deliver and the perception of consumers. In fact, there is a significant gap in the areas of personalization, ease of product opening and engagement, ‘knowing the customer,’ and empathy, according a survey on 150 financial institution leaders and more than 1,500 consumers.

A Harris Poll survey, commissioned by Redpoint Global, not only confirms a disconnect between perception and expectation, it reveals that the disconnect is substantial.

To begin with, just 26% of consumers say financial brands deliver excellent CX. More than half of marketers, though, rate their performance as ‘excellent.’

Between consumers and financial brands, the experience perception gap stands at 25%. And while it has narrowed since the last study in 2019 – when consumers differed with institutions by 30% – it still is alarming.

The research also found that 55% of consumers feel ‘unseen’ and 48% feel ‘undervalued’ by the brands they interact with. Comparatively, 95% of financial marketers believed they were headed in the right direction, were doing an excellent/good job of implementing new customer engagement technologies (96%), delivered personalized CX (93%) and are keeping up with consumer expectations (92%).

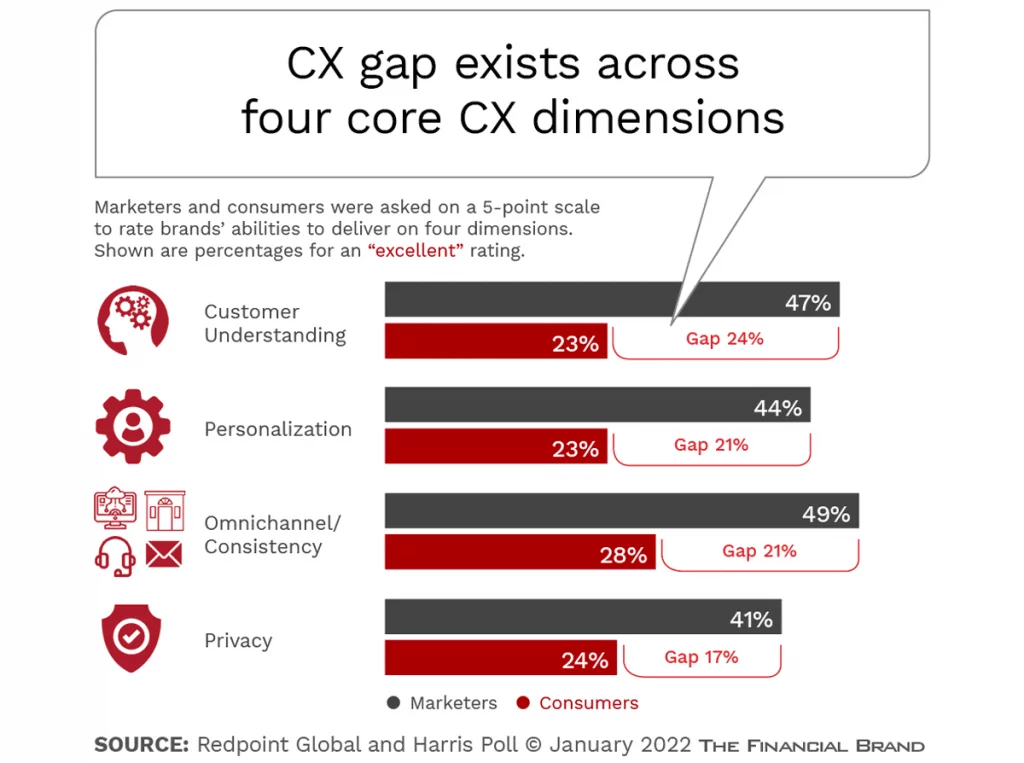

Performance Gap Across CX

The gap in customer experience performance exists across all of the key dimensions of customer experience, with marketers consistently rating their ability to deliver CX significantly higher than the customer’s perception. The biggest differences were in the ability to deliver excellent CX in the areas of understanding the customer (24% gap), personalization (21% gap), consistency across channels (21% gap), and privacy (17% gap).

Banking Industry Held to a Higher Standard

Consumers said they expect financial institutions to deliver similar levels of experience as retailers, but only about 25% of consumers saying these industries are doing the best job.

More than 80% on consumers expect banking providers to personally understand them, according to separate research by Redpoint Global on financial services. Yet, only 38% say their provider is effective in doing so. And about 88% of consumers expect a seamless, relevant, and timely experience across all communications channels, but less than half (45%) felt their institution effectively achieved this objective.

Consumers also believe non-traditional financial players are doing a better job than legacy banks in delivering a personalized experience. For instance, digital-first financial services, such as Apple, QuickenLoans and SoFi were perceived by more than half of consumers (54%) as investing much more in personalization versus traditional banks. This correlated with the perception that these organizations placed the consumer more at the center of the relationship.

Digital Transformation Imperative

When marketers were asked about the requirements for improved customer engagement, creating personalized experiences that are contextual, timely, and valued by the individual consumer was considered the most important, followed by the ability to deliver services across channels that are available at any time 24/7/365.

Consumers said institutions need to go beyond the basics in spades:

- 82% of consumers said they expect brands to accommodate their preferences and expectations,

- Nearly all (70%) consumers said they will only shop with brands that personally understand them,

- Personalization must include website design, advice and recommendations, with 49% saying that personalized content/offers increase the likelihood to make a purchase, and

- A quarter of consumers say they are less likely to do business with brands that do not embody their values.