Bank customers and credit union members do a significant amount of research before purchasing a financial product or service. More than half of the customers considering buying a new product seek out information prior to the time of purchase, according to a Gallup U.S. Retail Banking Survey of 9,000 financial service consumers.

In fact, Gallup research found that customers who looked for information had a 17% lift in eventual sales conversion rates.

If you’re a leader at an institution, you might be thinking ‘when customers come looking for information, we’ve got a pretty good chance.’ Don’t forget that most consumers don’t know the difference between a bank and a credit union; they also don’t know the difference between a bank and a multitude of other companies they consider to be “financial providers.” Consumers have as many as 30 relationships with different “financial” companies. Your information channels are competing against every other provider’s channels.

Financial institutions must identify their most influential information sources for converting the ‘pondering’ customer into a ‘sold’ customer.

Need to know how banking consumers engage by channel? Here it is.

(Regardless of financial institutions’ definition – or preferred term – for cross-sell, we take the term to mean creating revenue by deepening existing banking relationships.)

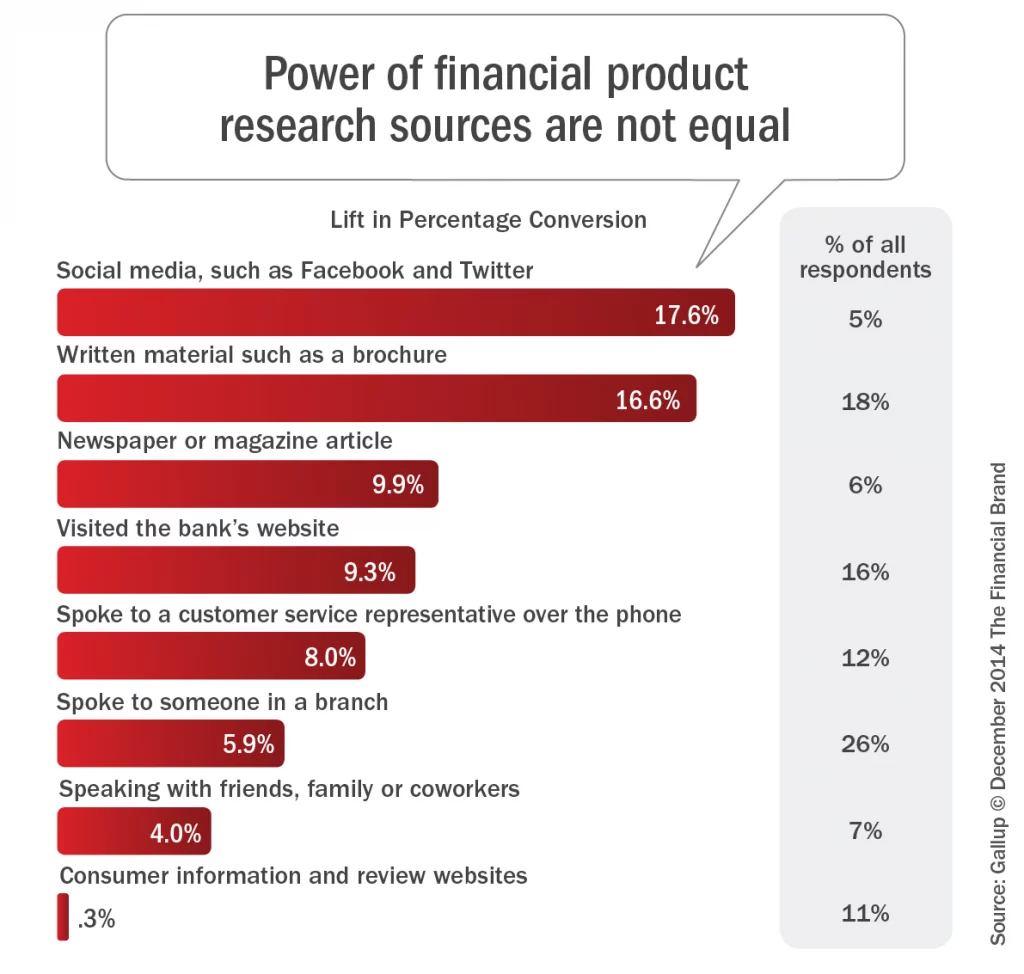

Not surprisingly, Gallup research found that social media was the most effective channel used by customers that lead to sales conversions. What may be a surprise to many is that written material – direct mail and email –was the second most effective selling tool for banks and credit unions.

Interestingly, the channels with the highest cost to the bank – speaking to someone in the branch or a customer service representative over the phone – provided much lower conversion rates.

As banks and credit unions manage multiple communication channels to effectively and efficiently move potential customers through the sales funnel, financial marketers should ask themselves the following questions as they allocate resources:

- Do we know where our customers, specifically, are looking for information prior to purchasing?

- Are we delivering a consistent message across sales information channels?

- How do we balance our resources between those channels that are high impact in conversion but low in usage (i.e. social media) vs. those that are high in usage but have lower impact in conversation (i.e. spoke to someone in a branch)?

- Do we know what our customers value in a bank and are we delivering on the message at every touch point?

- Do we know what actions we need to take to increase conversion rates in each channel?

Total Expert’s Analysis: The Opportunity

Banking marketers should consider the value of volume within information channels – even when they have lower conversion rates than other channels. Consumer behavior can make up for a low conversion rate. For example, because more than 1 in 4 shopping consumers went to a branch, it provides more conversions than any other channel — with the exception of print and email marketing.

Print and email marketing, on the other hand, have an amazing conversion rate of 16.6%. But, so few consumers ‘use’ those channels, that they way underperform in terms of volume relative to the channel’s conversion rate.

Just in case you aren’t seeing the irony, here’s what’s interesting:

For every 100 customers researching a product, nearly 3 convert from print and email, about 1.5 converts from branch visits, and the website converts just more than 1.4. That means:

Print and email have DOUBLE the conversion Volume.

Unfortunately, less than 1 in 5 consumers ‘used’ emails or print materials. Why is that odd? It’s because – unlike consumer actions like visiting a branch – the bank marketing team controls how often consumers receive information through those channels.

Why would consumers not ‘use’ print and email then? It’s because bank marketers either don’t use it, or don’t use the channel well, or face challenges in harnessing the much higher conversion rate of those channels.

According to a Total Expert study of 200 financial, about 34% of bank and credit union leaders say they still manually leverage data for segmented messaging; 23% have limited access to data with which to send emails, and another 28% just send the same message to all customers.

In fact, Total Expert analysis shows that the single greatest challenge facing financial institutions when it comes to print and email marketing is efficiently utilizing data for print and email journeys. Financial leaders say their staff remains bogged down with manipulating segments manually, and by the raw volume of work needed to produce truly valuable, segmented, personalized messaging.

Consumers offer banks and credit unions one of the highest conversion rates possible in print and email marketing. Now institutions must find partners who will help them skip the beginner phase in digital marketing. Those who do — thus freeing their staff to develop game-changing experiences rather than spending time manually manipulating data — will become the true frontrunners in the race to engage customers.

Improving Cross-Sell at Financial Institutions

Now, we’ve covered how engaged customers or members are the most likely – even more than satisfied consumers – to deepen their relationship with a financial institution. And we’ve also covered how institutions can meet customers or members where they are engaging.

Here are Jim Marous’ recommended steps for banks and credit unions to excel at engaging customers and members to support deeper product usage and greater loyalty within the relationship: “Guide: Improve The Cross-Sell Process.” (Coming Soon)

Editor’s note: Italics indicate edits to the original to accommodate layout or to provide additional information or resources for this series.